Stay in touch!

Subscribe to our newsletter to get the latest updates on live market analysis, trading strategies and more. You can unsubscribe anytime.

By subscribing, you agree to Trading.live Privacy Policy.

The so-called trend trading is what we usually call following the trend.

So what does it mean to follow the trend? Going with the trend means that when the market trend is upward, then go long along the trend line; if the trend is downward, open short along the trend line; if it is a box arrangement, then sell high and buy low .

Then, in order to follow the trend, there must be a trend first.

What is a trend?

The Dow Theory, the patriarch of technical analysis, defines it as follows:

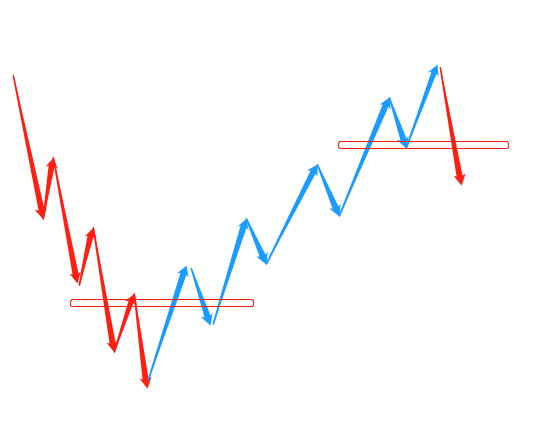

Under normal circumstances, the market does not go straight in any direction. The characteristic of the market movement is twists and turns. Its trajectory is like a series of successive, ups and downs, with obvious peaks and troughs.

The trend is exactly the direction in which these peaks and troughs rise or fall in sequence. As these peaks and troughs increase or decrease sequentially, or extend horizontally, the evolution of their direction constitutes the trend of the market.

Any trend will not appear out of thin air, it has a starting point and an end point. This area connecting the end of the old trend and the beginning of the new trend is what we usually call an inflection point!

In this way, returning to the main question, the answer comes, how to judge the beginning and end of trend trading? In fact, how to grasp this inflection point is as simple as that! If you catch the first inflection point, that is the beginning of the trend; then you catch the second inflection point, that is the end of this round of trend and the beginning of a new round of trend. In a word, the trend continues before the inflection point (old trend), and the trend reverses after the inflection point (new trend comes). Refer to the figure.

However, predicting the inflection point is often easier said than done, and it is very clear after the fact, and there are various entanglements in the matter. The most classic case is that a generation of master Benjamin Graham misjudged the beginning of the Dow’s upward trend in 1929. And the fact that it almost broke the warehouse.

So, how can we grasp this inflection point well, or grasp the beginning and end of the trend? Personally, I think that the sharp tool for judging the inflection point lies in the technical form + wave theory.

We know that there are two main classifications of technical patterns-reversal patterns and continuation patterns. Reversal patterns are true to their name, meaning that a major trend reversal is taking place, which is often the area where the turning point is located. The wave theory can divide the trend of the market by counting waves, and the junction of the impulsive wave and the adjustment wave is often the area where the inflection point is located.

If the reversal signal in the technical form and the wave type boundary in the wave theory are combined, and where they overlap, then the probability of the inflection point is often close to ten. Combined with the direction of the wave type, then the beginning of a trend and The end is on paper.

Copyright reserved to the author

Last updated: 08/06/2023 11:35

How to judge the trend is a relatively core issue in the entire financial trading industry. The judgment of the trend is also a problem that has to be faced in the construction of the trading system. It can also be said that whether the trend judgment is correct or not will directly affect one of the important factors for whether you make money in this transaction. Below I will share how I judge the trend. Maybe my judgment on the trend has not reached the perfect level in my mind. I also hope that someone in the same way can give some pointers if they find a problem.

1. It is hooliganism to talk about trends without the cycle. The problem of the trend must be in the early stage of the cycle. Without the trend of the cycle, it is meaningless. This is what I have always believed. Do you still remember that many people may ask, what do you think of gold and the euro today, such questions that you cannot answer. In fact, you can understand what he wants to express, but you can't talk about it. The main reason is that trends and cycles are inseparable.

Take crude oil products as an example. For example, the weekly chart of crude oil shows an upward trend, while the monthly chart of crude oil is only in a rebound adjustment stage in the process of falling. The 1-hour chart of crude oil is indeed a shock adjustment, and the sense of trend is not strong. strong trend. We know that a large cycle is composed of small cycles. The trend sense of a large cycle is relatively stable, while a small cycle is relatively sensitive and changes quickly. Whether to choose a small cycle or a large cycle is a problem that has to be faced in the transaction process.

2. After choosing a good cycle, you are qualified to judge the trend. My personal tools for judging trends are mainly based on the definition of Dow Theory. The upward trend is that the highs and lows of the rising band and the retracement band continue to rise, and the same downward trend means that the lows and highs of the falling band and the retracement band continue to decrease. In short, it is the relationship between peaks and troughs. As long as there is no alternation between the peaks and troughs of a wave of trends, it means that the rhythm of the market's rise or fall has not changed, and the trend may continue.

In my opinion, the chart above basically illustrates the beginning and end of a trend trade.

Theoretical basis: The essence of price movements is often manifested through phenomena, which are our common signals. Whether the market is rising or falling, the fact that it is rising or falling must be expressed by specific price action, and its appearance is indeed one of the ways we find trend signals. Assume that the process of price rising from B to E is a given. However, there may be many rising paths from B to E, but the result is certain, and the signal reflected by the result is determined by the operation space. No matter what breed, no matter which cycle, there are such characteristics.

In the process of price movement, there must be traces of movement. And our technical analysis is to use various tools, indicators, trend lines, etc. to discover the trace, and then discover the trend and follow the trend.

Although, the principle is very simple. But even if you understand how to judge the beginning and end of the trend, although the trading profit is close at hand, it is not easy. There will still be problems in the process of judging the trend. It cannot be expressed in words, it can only be slowly formed and discovered in your future trading process.

Copyright reserved to the author

Last updated: 08/04/2023 14:30

In financial transactions, everyone likes to do trend market, because doing trend market can generate huge profits.

To do trend market, we must first identify the trend.

That is to identify the inflection point between the upward trend and the downward trend, and only when you find this inflection point can you enter the market.

The beginning of a wave of trending market is also the end of another wave of trending market.

Accurately grasping the trend is a headache for many investors. It is also the goal that many investors have been striving for for many years. So now, the author will share with you two methods of finding trends. These two methods are part of the essence of the author's years of investment experience. Of course, it also conforms to certain logical reasoning principles.

1. Breakthrough method:

1. First determine the time of the most recent major fundamental event in the future on the financial calendar.

2. Find an important resistance zone in the previous market.

3. After a major fundamental event occurs, enter the market after the market crosses the previous resistance range.

The legend below

The principle of breakthrough method:

The announcement of major political events, military events, or financial events will have a major directional guidance on the financial market. For example, national policy guidelines, interest rate adjustments, etc. This is just like the major decisions in our lives. The reason why a major decision can change the trajectory of life is the same. There is a game between accumulated funds in the past and the current promotion. If the past is forced to follow the past direction, if the present is forced to follow the current direction. When the price breaks through an important resistance area in the past direction, it will change the original direction and generate a new direction.

Second, the reversal method

1. First find an important high and low point in the previous period.

2. Find an important resistance zone outside the previous high and low.

3. When the price breaks through the previous high fixed point and reaches this resistance range at the same time, it is an opportunity to enter the market.

The legend below

Principle of inversion method

This approach is to use the resonance effect of the current fund closing and the entry of reverse funds.

From the perspective of fundamentals, no matter how important an event is, its impact on the market is always limited.

From a technical point of view, a wave of rising or falling waves will inevitably have profit-making liquidation, and the place with the largest liquidation funds is after breaking through the previous important high and low points.

After breaking through the important high and low points in the previous period, and reaching a resistance zone at the same time, the resonance effect generated by the entry of liquidation funds and reverse funds will guide the direction again.

Therefore, this place is often the end point of the current trend and the starting point of the reverse trend.

Copyright reserved to the author

Last updated: 08/06/2023 04:12

In front of the market, everyone has their own opinions, everyone has their own expectations, and everyone has their own trading system, which conducts long-short trading on the current price, so a new current price is generated, that is, Saying that this price already includes everything, this price is the concentrated expression of the expectations of all market participants.

Therefore, if there is no change in the fundamentals, the price will fluctuate within a small range, because neither the bulls nor the bears have enough power to completely overwhelm each other. was broken.

The bullish funds are obviously greater than the bearish funds. There are more and more people buying, and more and more people are afraid of losing the opportunity to get in the car. They are willing to keep chasing higher and continue to trade at higher prices, which is reflected in the price It is the continuous rise, which is the initial stage of trend formation.

When the price rises for a period of time, market participants begin to discover the changes in the market. Some of them will start to pocket their profits in the early stage, and some will think that the price is too high and will go short in reverse. The loss will also come out, and the trend follower has also reached his breakthrough entry point at this time.

All the long and short sides will have a new round of competition. At this time, the strength of the two sides will start a game. If the strength of the long side is stronger, the market will rise further. During the rising process, the strength of the two sides will reach a balance again. Then the market will start to fluctuate further at a high level, and whether the price can continue to move forward depends on whether there is good news in the market and whether more bullish funds continue to be attracted, so that the strength of the bulls will be stronger than that of the bears , so the trend is generated in this way.

We have no way to stop this process. Due to the change of power in this process and the long-short game between the two sides, we have no way to grasp the news, because every market participant, their expectations for the future may change rapidly. .

Moreover, we have no way of predicting when good or bad news will come out, nor can we predict everyone's thoughts, so we say that the trend is unpredictable. There is no way to predict when the trend will come, so since we can't predict it, we just follow it.

We have to try the trend with the mentality of trial and error when entering the market. If we try it right, it is a trend, then we just hold it, and if we try it wrong, we can stop the loss. And we can't predict when the trend will end, so we don't have to think about whether the current price will be too high, we only need to bear a certain profit retracement to let the profit run.

I am a professional trader, and I have been trading for 13 years. If my sincere sharing is helpful to you, please pay attention, like it, and share dry trading goods every day, so that you can avoid detours

Copyright reserved to the author

Last updated: 08/30/2023 18:52

How to judge the beginning and end of trend trading? Can you introduce the system?

Objectively speaking, no one can judge the beginning and end of a trend every time. If there is such a person, his current wealth is many times that of the richest man in the world.

However, there are still many people who judge occasionally. This requires years of study and accumulation of experience.

Dow Theory is the ancestor of trend judgment, but if this theory is used in actual combat, it is not satisfactory. It is best used in strategic judgment at the "Tao" level.

The Dow Theory extends a variety of trend trading techniques, such as moving averages, trend lines, wave theory, etc. These are techniques at the "technical" level and are more applicable to actual combat.

There is a paradox in trend trading here, that is, the more you want to guess the top and bottom, the less likely you are to achieve a big market; and the stronger your ability to make a big trend, the more you guess the top and bottom ability will be lower.

Because when you judge the top and bottom, you correspondingly cut off the possibility of the trend continuing; and when you judge the trend continuation, you also cut off the possibility of the market going out of the top and bottom.

Every time the top and bottom of the market are determined, it can only be 100% determined after the market has passed.

So at every moment, what we can do is always a probabilistic judgment.

How to coordinate these two abilities well is the homework that every trader must do throughout his life.

Generally speaking, there are some ways to judge the top and bottom of the market:

1) In the first case, it is more difficult to judge the top and bottom when continuously hitting new highs or lows in history. At this time, if you want to "guess" the top and bottom, several methods you can use are:

1. K-line patterns, such as hanging man, hammer line, cross star, engulfing pattern, etc.;

2. Line of reaction force;

3. Golden section;

2) In the second case, medium and short-term tops and bottoms often appear at the level of double tops and bottoms and triple tops and bottoms in the large cycle. The correct rate of judging the tops and bottoms of this situation will be a little higher. The method used is similar to the first case.

It should be noted that if there is a large and small cycle resonance, the winning rate of judging the top and bottom will be higher.

Copyright reserved to the author

Last updated: 08/20/2023 18:49

I divide the process of trend occurrence and development into five forms: trend occurrence, trend breakthrough, trend continuation, trend decline, and trend reversal . In fact, the trend reversal form is the occurrence process of the next reverse trend. Therefore, a complete The trend has only four processes. It should be pointed out that the trend pattern is different from the price pattern. The price pattern is only the pattern of the current market. There are only two situations: breakthrough and reversal. The transaction price is higher than the other, which is a breakthrough. Originally, one is higher than the other. The sudden appearance of a lower transaction price is a reversal. The price pattern is a meaningless fluctuation of market development, and generally has nothing to do with the general direction of market development.

Trend pattern refers to the pattern change that can point out the general direction of market development. Take bulls as an example:

(1) Trend occurrence: The occurrence process of a bullish trend is the process of the decline and disappearance of the previous short trend; the reason for the demise of the short trend is either that the short-selling force fades and short traders leave the market at a profit, or the long-selling force joins and eliminates The original short trader; trading is like a war between long and short sides. The new trend must continue to move forward on the dead body of the old trend. When the strength of one party is completely eliminated and the market shows a general direction, you can judge the new trend. The trend has occurred; the form of the trend is that the market breaks through to a new high point, then pulls back and then reverses to form a higher low point, which is the lightning line.

(2) Breakthrough of the trend: Most of the trend occurrence forms present a oscillating price form, or a box oscillation, or a flag-shape oscillation. Different oscillation forms show the difference in strength between the long and short sides; when the trend goes out of the occurrence form , nor can it be judged that the new trend is formally established, because it is easy to be eliminated in the bud. Only when the price completely breaks through the shock box can the formal formation of the bullish trend be confirmed. This is called a trend breakthrough; an ideal trend breakthrough is not only It is required that the price break through the edge of the box, and if there is a callback in the follow-up market, the low point formed by the callback should preferably be outside the box. If the callback point returns to the inside of the box, it is better to wait for another price breakthrough If the callback exceeds the middle of the box, it is judged that the newly formed trend has died.

(3) Trend continuation: When the market price goes out of the box that breeds the trend, there will be a series of ups and downs in the market, so there are two price patterns to judge that a trend is continuing. One is continuous breakthroughs to generate new highs Second, even if there is a callback in the market, it will not break through the point of the previous callback. Ideally, the callback point during the continuation of the trend will not enter the area covered by the lightning line of the previous callback.

(4) Trend decline: When the price market starts to go out of more callbacks, especially when the low point of the callback exceeds the previous callback position, although new highs can still be produced, the market has begun to develop into a oscillating pattern. It can be judged that the current trend has declined. The trend decline only means that the current long-term strength has faded, and it does not necessarily mean that it will be reversed. If there is a new long-term strength to join, the price breaks through the recession and shock area, and the current trend remains the same. can be continued. Only when a reverse trend pattern occurs within the trend recession area can it be judged that the current trend has reversed.

The four trend patterns described in detail above are only based on the consideration of the price pattern, that is, the performance on the bare K-line. I have always emphasized that my system operates based on trading momentum, so to judge the above trend pattern, you must also refer to the momentum system indicators, that is, the moving average and the MACD system. Among the four trend patterns, the ideal entry position is the breakthrough position, so my trading system uses "momentum breakthrough" as the entry signal. Of course, the premise is that the trend occurrence pattern has appeared through the price pattern first, and the role of MACD is mainly It lies in the process of trend tracking, and cooperates with the trend shape to judge whether the trend is continuing or declining. The position of trend decline is the position of exit. Even if the trend will break through the recession area and continue to develop, you can treat it as a new trend.

Finally, I would like to emphasize that not all market conditions are trending conditions. For example, a V-shaped reversal is composed of two opposite and symmetrical unilateral market conditions. This situation does not belong to the trend pattern I am talking about. There is no perfect unilateral market, and there will always be certain callbacks and shocks. If the most perfect unilateral market is unfolded with the K-line of a lower time period, it will also show shocks and callbacks. As long as there are callbacks and shocks, you can Use the above four trend patterns to analyze.

Copyright reserved to the author

Last updated: 08/20/2023 04:43

First of all, it needs to be explained that it is more difficult to do trend trading than short-term trading because the trend means suffering and constant self-struggle.

The requirements for people's experience, knowledge, and mentality are very high, so do what you can and first consider whether you are suitable for large-cycle trend trading types.

First of all, let me explain that long-term and stable trend profits are made, not seen!

In the trend trading we do, it is divided into short-term trend, mid-line trend and long-term trend. If you observe carefully, you will find that all trend graphics are actually the same.

A long-term rise will fall, and a long-term fall will rise, but the cycle you face is different. Many people say that the long-term cycle pays more attention to the promotion of the market. In the short-term, there is no need for too much news, but we will find market news after sitting. Where did it come from, or can you grasp it when it comes?

Let's take a simple look at this issue, not be controlled by market factors, and only do our own transactions.

The relevant experience on how to judge the beginning and end of trend trading can be briefly shared with you

The following experience sharing only assumes a systematic trend market judgment suggestion, because there are too many trend market factors,

There are also many forms that we face, so we will briefly cover them. It is convenient for everyone to understand.

When your system trading is stable in a similar cycle (one-hour or four-hour cycle can be used as the standard), you can still follow your small cycle method when enlarging your cycle.

Proportionally enlarge your stop loss, take profit and increase and decrease positions. Don't move if the market is not moving, and don't move if the market is moving, unless it is absolutely necessary, don't intervene manually.

One detail that needs to be paid attention to here is that it is recommended that the system for you to do trend market is best to like unilateral varieties, such as Meirui and crude oil!

Regarding the end, you can use part of the discarded profit to make an end. For example, if the normal profit is 100 points, it can be ended when the profit is adjusted to only 80 points.

Regardless of what the market looks like, just give yourself a set of standards. Because the market doesn't think you, but it thinks. This set of methods is only for predestined people.

Readers, if you are interested in my answers, please pay attention to my Huihu account. I will answer some industry-related questions regularly, not seeking the most professional, but seeking the most authentic.

Copyright reserved to the author

Last updated: 08/06/2023 09:04

1. The start and end cannot be determined 100% in advance. In hindsight, you can know where it starts and where it ends, for example, a golden fork starts and a dead fork ends.

2. The question you asked is to find a certain thing that can know the beginning and end beforehand. This is the tip of the horns of thinking, a pit. After many twists and turns, I finally gave up on this certain thing. Then I understood—before the event, you need to assume that this golden fork is the beginning, and that dead fork is the end of the matter.

3. The trend is divided into levels, the large level fluctuates, and the small level is observed to be composed of multiple rising and falling trends.

4. Trends are driven by funds, funds are driven by players' games, games are driven by participants' expectations, and expectations are driven by events. Trends cannot exist independently of games, expectations, and events.

5. The smaller the trend, the less likely it is to identify games and expectations, and it is less able to combine events. The larger the level of trend, the more exposed the game and expectations.

6. The ability to obtain information in small quantities can only increase the probability of a hypothesis being hit in a large-scale trend. But small fans like to make assumptions at a small level, so most people lose.

7. Few people will realize that they are also playing games in the market. The game needs to maximize strengths and avoid weaknesses, but few small groups will analyze their own strengths and weaknesses, allies and opponents in the market. Most newcomers are thinking: "I just need to decipher the law of the beginning and end of the trend in the chart, and I can make a lot of money."

8. In the game industry, there are still people who naively think that someone will disclose their game core at will, such as "what's the use of you talking about the truth, just tell me how you enter and exit the game and you're done."

Copyright reserved to the author

Last updated: 08/14/2023 06:03

How to judge the trend

How to judge the trend is very important. If the trend judgment is wrong, it is meaningless to follow the trend and go against the trend. Because you don't know the current situation at all, so how can you go smoothly?

There are still many methods of trend judgment, such as moving average system, Dow theory, trend theory and so on. But we must use a fixed set of methods, that is, our own set of methods for judging trends, so as to achieve consistency before and after trend judgments. Here I will introduce a method to you, which still combines these classic trend analysis theories.

First of all, we divide the direction of the trend into rising, falling and sideways, which is not a big problem. The second is to divide the level of the trend. We generally divide the trend into small-level trends, short-term trends, medium-term trends, and long-term trends.

01Small level trend

The small-level trend refers to the performance of the price in a short period of time, usually between 1-3 days. Small-level trends often occur in short-term trends and are in the opposite direction, which is what we call small-level rebounds or callbacks, but this has little effect on the overall trend. And once the small-level trend is replaced by a new high or new low, it is often a better entry point, whether it is to open a position or increase the position.

02 Short-term trend

Short-term trend refers to the behavior of prices in the short term, rising, falling or sideways. We generally see whether his price is a new high or a new high in about 3 to 10 days. If yes, then we can say that the current short-term trend of the price is up. The same is true for the short-term downward trend, except that the price is a new low within a specified time. Of course, it would be best if the closing price of the day can maintain this new high or new low.

How to understand the new high or new low from 3 days to 10 days? The 3-day new high means that the third day's high is higher than any of the highest points in the previous two days, and we can call it a 3-day new high. Then 10 days is also understandable, and the new low is the other way around. In addition, we should also notice that short-term uptrends and short-term downtrends alternate cycles. In other words, between two short-term rises, there must be a short-term downtrend.

03 mid-term trend

The medium-term trend is to extend the time period appropriately, generally refers to about 20 days to 50 days, whether the short-term trend hits a new high or a new low within the specified number of days. Here the short-term trend and the day in the short-term trend mean the same thing, that is, we take the short-term trend as a whole (that is, one day in the short-term trend), and then see whether the current price of the whole has reached a new high to judge whether the current price is in mid-term uptrend. Then, the mid-term downtrend is the same reason.

04 Long-term trend

The same is true for the long-term trend, as long as the time period is extended, but this does not require a very detailed understanding, because the general trend can still be seen clearly at a glance. On the contrary, the short-term and medium-term trends are not very clear to everyone. In addition to this method of judging the trend level, we can also verify the accuracy of the current trend judgment based on the trend line. The short-term trend uses the short-term trend line, which is to connect the low points of the price in turn to see if they form a straight line. The medium-term trend is to connect the low points of the short-term trend to see if it is above this straight line. In essence, the biggest function of the trend line is to judge the strength of the trend development. The medium-term trend is composed of a short-term uptrend and a short-term downtrend. The long-term trend is composed of a medium-term upward trend and a short-term (or medium-term downward trend). At the same time, the development of the trend also has strengths and weaknesses.

The strength of the trend, one is to look at the slope of the trend line, the steep rise is generally a strong rise; the other is to look at the daily line combination, a strong upward trend is generally a continuous positive line. The last is whether there is a general trend to cooperate when it rises, and so on.

If a trend starts out strong, it tends to get stronger later on. This is the trend relationship of trend strength. This is also more important for the choice of opening point. After the trend is judged, some problems may be solved.

Trade with the trend Whose trend will follow?

First of all, I think we should follow the trend with a relatively high level of trend, and secondly, follow the trend with relatively high strength. In the mid-term uptrend, it is best not to rush to short; in the mid-term downtrend, you should not rush to go long, and in the mid-term sideways trend, you should not do more. So how to follow the short-term trend? Although there are also many traders who buy during the adjustment phase of the upward trend, this is to follow the trend of the freshman level, but it goes against the short-term trend in the short term. Although there is relatively large room for profit in this operation, you must not buy early during the adjustment, otherwise you may stop the loss or clear the position before the upward trend arrives. Therefore, I think it is best to follow the short-term trend.

Following the short-term trend can put you in a more flexible position, but as long as you follow the trend, there will be a problem, that is, the buying point is too high in the short term, or the price will be adjusted slightly after buying. In order to avoid this problem, we can buy in the early stage of short-term trend formation. So this can provide a profit guarantee for future purchases, how should I say it? If you have made some profits in the first position, then there will not be too much psychological burden if there is a certain loss in the second position, which provides a guarantee for smooth short-term adjustments, and once the price strengthens again, then you have already Into profit, you can deal with price fluctuations with peace of mind.

It is also a normal psychology to hold a profitable position than to hold a loss position. Some traders feel at ease when they hold a losing position, which is an unhealthy psychology. In other words, if you start out with a winning position, you have a better chance of catching a big move. Therefore, this involves the best entry position. Because the ratio of profit and risk is the most ideal at this time.

Copyright reserved to the author

Last updated: 08/09/2023 16:59

To determine whether the trend type is over, it is mainly based on the following points:

1. Standard trend divergence point

2. Large-scale consolidation divergence point

3. The consolidation divergence point of the third type of trading point

The details are as follows:

1. Standard trend divergence point

This is the simplest ending point, because it is the most standard trend ending point, but the market is not standard, so this kind of trend is rare!

2. Large-scale consolidation divergence point

For example, if the participation level is 5 minutes, how to judge whether the 5-minute trend type is over? At this time, if the 5-minute trend type does not have the first situation, then it is feasible to use a large-scale consolidation to judge. The premise is that a large-level center must be formed first. Judging whether the 5-minute trend type involved is at a point of consolidation and divergence from other trend segments in the same 5-minute direction of this center.

If it is, then you must pay attention to the sub-level or even sub-level reversal of the 5-minute trend type you are participating in. This kind of situation often happens when the minute center is formed and the sub-level or even 1 minute away will turn from small to large. Invert, then go straight back into the 30-minute center.

Of course, you should pay attention after the reversal. If you can’t go back to the center for 30 minutes, it will be the situation where the back of the market forms the third buying point.

3. Consolidation and divergence after the third trading point

The third buying and selling point here is the participating 5-minute third buying and selling point, not a large-scale third buying and selling point, for example, to participate in a 5-minute trend type, although this trend type is in the same direction as the large-level 30-minute center The 5-minute trend type of the segment did not appear to be consolidating and diverging. At this time, the participating 5-minute trend type has a 3rd buying point and the 1-minute trend type after the buying point has a divergence, so we must pay close attention to it later!

What to focus on? If this 1-minute callback trend type is completed, the next upward 1-minute trend type ends, because it is very likely to form a second 30-minute center or expand the first 30-minute center later, unless the latter The 1-minute trend type has been greatly increased again, so that the participating 5-minute trend type and subsequent trends are still in a 5-minute trend type, or a 5-minute trend type line segment rises!

Copyright reserved to the author

Last updated: 08/14/2023 20:35

In fact, this problem is transformed into how to find entry and exit points for trend trading. Let me talk about how to find entry points.

1. Breakthrough buying - a very common way

Breakthrough trading is the most classic mainstream trend trading entry method, easy to operate and easy to execute, as long as the price breaks through a key important support or resistance level, a wave of significant market may appear immediately; the shortcomings of breakthrough trading methods are often entered Costs are less than ideal, slippage increases, and profit margins are cut.

2. Entering the market before breaking through - it is necessary to predict the trend

The cost of entering the market before a breakthrough is lower than the cost of buying a breakthrough, which requires you to have a strong ability to predict the trend of the market. If you cannot break through as predicted, you will fall into a shock or reverse development, which will make it difficult for you endured. Here is an example of a head and shoulders neckline breakout:

3. Retracement to buy - not every breakthrough has a retracement

Choosing to buy through a breakthrough is a relatively stable way to enter the market, because he can confirm whether there is a breakthrough and avoid false breakthroughs, but not every breakthrough has a pullback opportunity for you to intervene.

Copyright reserved to the author

Last updated: 08/14/2023 12:11

How to judge the beginning and end of trend trading?

This is simple, that is, when a trend begins, such as an upward trend, then you go long at the beginning of the trend and cash out at the end of the trend, while the downward trend is just the opposite.

So, here comes a new question, so how do I judge the beginning and end of this trend? Or, more precisely, how do I know when a trend in the breed I'm trying to start? What is the trend? Up or down?

At this time, we need to use support levels, resistance levels, trend lines, channel lines and other tools to analyze and judge. As long as the support level and resistance level are not broken, it is often the beginning of a new round of trend; while the trend line and channel line, as long as they are not broken, are often the continuation of the old trend.

Of course, their roles can often be interchanged, and the key points will not be unbreakable. Therefore, how to judge the start and end of trend trading is impossible to draw general conclusions, let alone the dogmatic answers in textbooks. It needs to be adaptable on the spot.

Copyright reserved to the author

Last updated: 08/01/2023 23:17

In a cycle, if it is an upward trend, there is a high point a1 and a low point b2, when the price retraces and does not break through point b2, you can enter the market to do long. Generally, the high point a2 will be broken, and then the low point b2 will be formed until the high point n is formed. , when the price does not break through the high point n once, but forms the second high point 1, you need to pay special attention. If the price falls below the swing low point b before the high point n, the market may reverse into a downward trend. If not It will become a volatile market, waiting for the market to break through again to confirm the new direction.

It should be noted that this is only in one cycle, and it needs to be coordinated with other cycle trends, because the upward trend in the 1-hour cycle may only be a callback to the downward trend of the daily line cycle, so it is necessary to review and summarize more, and follow the trend of the big cycle In trading, look for entry opportunities that conform to the trend of the large cycle in a small cycle, that is, trend resonance. for reference only! ! !

Copyright reserved to the author

Last updated: 08/06/2023 03:47

In my opinion, to complete a complete trend transaction, the following five problems must be solved:

First, techniques for identifying trends. Identify trends in the first 20% of their onset. This way we ensure that we have entered the market before most people have identified the new trend.

Second, measure the longevity of the trend. It is not possible to enter the market in the middle and late stages of the trend.

Third, the technique of holding a firm position. Guaranteed to hold positions in most of the trend segments during most of the trend development time.

Fourth, the technique of stop loss and take profit to exit the trend. It is necessary to set a stop loss to exit a false trend or a short-term trend, and to set a stop profit to exit a trend that has ended and reversed.

Fifth, the technology of increasing the price along the trend. This is very important for the overall account profitability, and it must be ensured that the profitable forward position is larger than the losing one against the trend.

The technology of trend trading is how to solve these five problems. After completing these five problems, you can basically accurately judge the start and end of trend trading.

Copyright reserved to the author

Last updated: 08/02/2023 16:10

The specific buying and selling points are generally vague, and the precise trend points are confirmed afterwards.

Take a look at these graphics in hindsight, and the starting and ending trading points are easy to choose.

Step back into the field:

In an upward trend, if the price retracement trend line does not break, then it is a safer buying point.

Breakthrough buy:

Effectively breaking through the downtrend line at the end of the downtrend indicates that the market is reversing and you can buy along with the trend.

Broken sell:

Once the price falls below the upward trend line, it means the end of the rising market, and it is the best policy to leave the market decisively.

Copyright reserved to the author

Last updated: 08/05/2023 20:24

How to judge the beginning and end of a trend is a difficult problem for all traders. After solving this problem, basically successful trading is a matter of course. Let me talk about my opinion below.

I judge trends mainly by using the definition of Dow Theory. The trend must be constantly switching between high and low points. Any trend change cannot be achieved overnight. It requires a process of change. In the process of change, we discover the clues of the market and the trend.

Spot the trend first, then follow the trend.

Theoretically, the trend manifestations of the market will unfold in this way. In simple terms, this is where trends start and end.

Copyright reserved to the author

Last updated: 08/02/2023 09:47

The core of the problem is how to judge the trend?

Of course, the big trend must be dominated by fundamentals, but it is vague. Furthermore, under the big trend, from the perspective of time cycle, there are many small trends mixed in.

From the perspective of daily use practice, it seems that there are only technical indicators for simple and convenient trend judgment.

Let’s take a look at MACD here. Some people call it the “king of the trend” indicator, which is actually a bit exaggerated. The lag alone can cause headaches for many people. However, the reference value it brings to you at different cycle levels is still universal.

MACD is often used to determine the trend in the chart. If the latest bar is larger than the previous bar, it means that the upward trend has started to form, otherwise it means that the trend has started to fall.

Take the entry point as an example:

In a bullish (bearish) trend, connecting the price lows (highs), you can enter when the candlestick chart meets the zero line and the trend line.

This makes for a simple uptrend entry.

Copyright reserved to the author

Last updated: 08/05/2023 21:28

I still remember that when we first entered the trading industry, the most common question we asked was "what do you think about XX varieties today?" We still ask such questions today, as if judging the trend is an eternal theme for traders.

Trend, the concept itself has great ambiguity. What is a trend may be a point of view that the beholder sees the benevolent and the wise see wisdom, and the trend is often related to the cycle. If we talk about trends without the cycle, we will basically fall into the category of agnosticism. The price of the monthly chart is in the process of rising, while the weekly chart is in the process of falling, and the daily chart is oscillating... So, which cycle can replace the trend, or can each cycle replace the trend? This may be A topic of contention. Therefore, the trend must be a topic that advances and retreats with the cycle. It is meaningless to talk about the trend without the cycle, especially for a trader.

Trend judgment is only a part of your trading analysis process. Correct trend judgment does not necessarily mean that your trading can make money. Trading must be a set of strict operating procedures, not an independent individual.

How to judge the trend?

First, choose the period of judgment. This cycle can be your analysis reference cycle or your trading cycle. However, since it is fixed, there is no need to change it. When you fail to deal with the correlation between the various cycles, frequent replacement cycles will not help you see the market clearly but will more likely make you more confused.

Second, fix the standard of judgment. If you use the moving average to judge, you can only use the moving average to judge. If you use the trend line to judge the current trend, you can only use the trend line. Don't always think about using many different judgment methods to achieve the so-called resonance effect. In fact, the result of doing so is that you can't achieve the resonance effect you want, but only make your own judgment contradict yourself.

Finally, the transaction is your own, and other people's trading systems may not be suitable for you. Instead of searching hard and verifying the trading system, it is better to build your own trading system based on the present.

Copyright reserved to the author

Last updated: 08/06/2023 08:59

It is basically consistent with everyone's opinion. If the high and low points of the band change, then the trend may change, but the first is only possible, and the second is what to do if the trend changes. Originally, I would use the disk mark to mark the rising market, the shocking market, and the falling market. But it won’t happen now, you just need to pay attention to making orders with signals in the right position~ so what if you go against the trend? There is a profit margin and a stop loss defense. So I’m currently in the process of castration, I don’t know if anyone feels the same~㊗️Go

Copyright reserved to the author

Last updated: 08/06/2023 02:39

Uptrend: Three golden crosses must be met at the same time: moving average golden cross, MACD golden cross and KDJ golden cross.

Downtrend: When the moving average, MACD and KDJ enter the dead cross state at the same time, it is a downtrend.

Judging the medium and long-term trend is based on the weekly and daily lines. When the three indicators are all dead forks, no operation is allowed.

When the three indicators are not unified, it means that it is in a shock stage, and there will be ups and downs during this period.

For a market with a downward moving average, it is in a downward trend and there is no need to operate.

When the waterfall line is upward and maintains an upward long trend, there is a basis for operation.

But when the waterfall line is upward, while MACD and KDJ are in a dead cross state, it means that it is in the process of callback from the high level to the waterfall line position.

Only when KDJ and MACD enter the golden cross state, the waterfall line turns from downward to upward, indicating that the adjustment is over.

A phenomenon that often occurs is that the dead cross is still in 60 minutes, and the golden cross rebounds in 1 minute, 5 minutes or 15 minutes.

When this happens, the long-term golden cross must prevail. For example, first check whether the weekly KDJ is golden cross, and then look at the daily line. In terms of operability, the rebound of the golden cross below 60 minutes can be given up. Because the rebound level is too low, it may start to fall again before the end of one trading day. It must be guaranteed that the rebound can be postponed to the next day before there is a chance to escape.

Copyright reserved to the author

Last updated: 08/05/2023 01:58