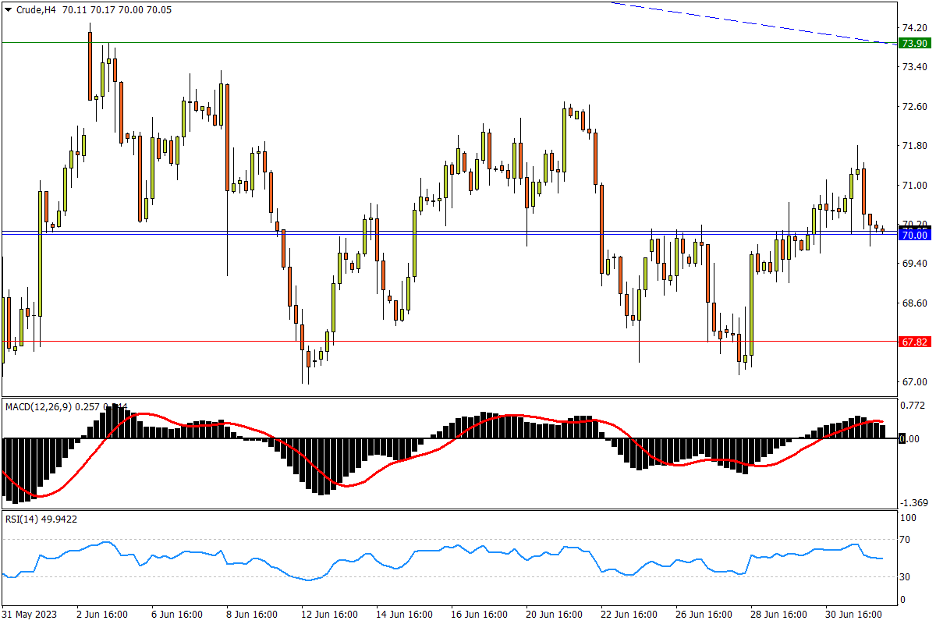

Chapter 4 07/04 CRUDE 70关口激战正酣,延续宽幅震荡格局

上方阻力参考: 73.90、76.20、77.70

下方支持参考: 67.82、65.00、62.30

日线图看,在沙特延长减产消息助推下,美油突破70关口。但在经济忧虑压制下,涨势很快失去动力,围绕70的争夺战并未结束。走势来看,市场仍处在67.82(2021年12月高位)至4月低点73.90宽幅箱体内的震荡格局依旧维系。上行压力方面,去年7月来形成的中期平缓下跌通道上轨,4月OPEC+突袭减产造成的大型缺口均为关键阻力参考。指标方面,MACD快慢线继续于零轴下方横向纠缠;RSI在中性水平弱侧走平,提示油价依然相对承压。

4小时图看,在67.82一带屡次受到买盘承接后,油价隔夜回落前呈现持续碎步上行的积极态势。但若回撤再次落于70下方,不排除再次下测区间下限的可能。67.82失守市场短线或将迸发强劲的下行动能,并将很快滑向65一带的年内低点。该位作为中期内多方最后防线,失守将重启中期下行通道中跌势。更多支撑可参考2021年12月低点62.30,以及60整数关。指标方面,MACD在零轴上方形成温和死叉;RSI在强势区显著回撤,呈现市场反弹遇阻的过程。

文章来源:FXTM富拓