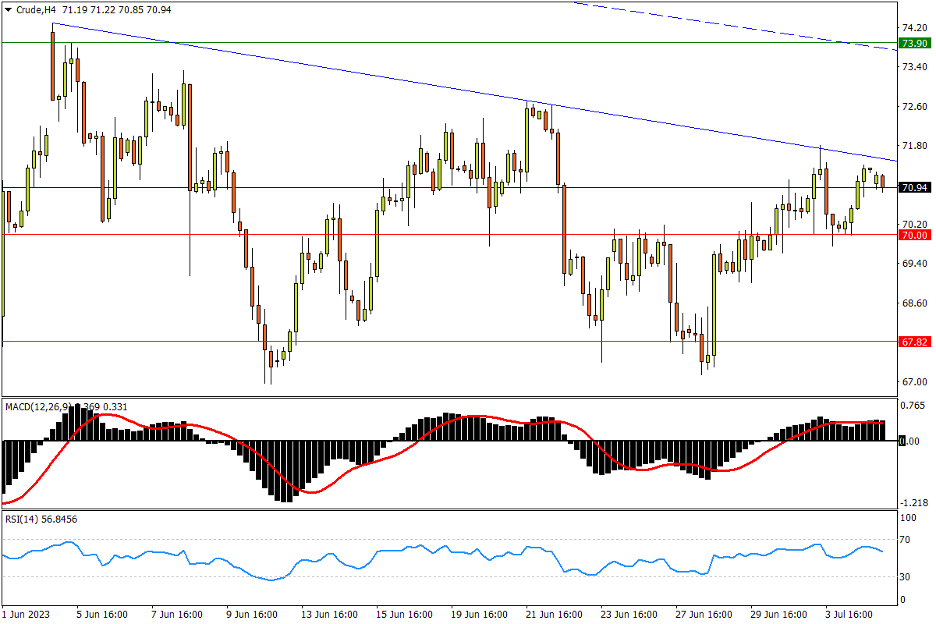

Chapter 6 07/05 CRUDE 回撤止跌于70关口,有望形成又一“牛角”

上方阻力参考: 73.90、76.20、77.70

下方支持参考: 70.00、67.82、65.00

日线图看,美油在沙、俄两国额外减产计划的助力下站稳70关口上方,过去5日有4日收涨。虽然累计涨幅不大,但已来到近期横向宽幅震荡区间高段,且有突破本月高点连线压力的迹象。不过上行即将遭遇4月低点73.90与去年7月来形成的中期平缓下跌通道上轨交汇形成的强阻。随后4月OPEC+突袭减产造成的大型缺口亦有持续抛压(包含3月1日低点76.20,以及2月14日低点77.70等阻力)。指标方面,MACD缓步升向零轴;RSI进入强势区,记录行情修复弱势过程。

4小时图看,隔夜美油回落站住70关口后形成短线波段的“更高低点”,该位不破则市场仍将维系微弱的强势;但若失守,则恐再次回测67.82(2021年12月高位)一线,此前该位曾屡次限制市场下行空间。若再跌破,市场短线或将迸发强劲下行动能,并很快滑向65一带年内低点。后者作为中期内多方最后防线,失守将重启中期下行通道中跌势。更多支撑可参考2021年12月低点62.30,以及60整数关。指标方面,MACD在零轴上方再次温和金叉;RSI升向超买线,呈现市场温和强势。

文章来源:FXTM富拓