Chapter 19 07/14 XAU/USD 1959附近横向整理,预计两千关口抛压较重

上方阻力参考: 1985、2000、2030

下方支持参考: 1928、1900、1877

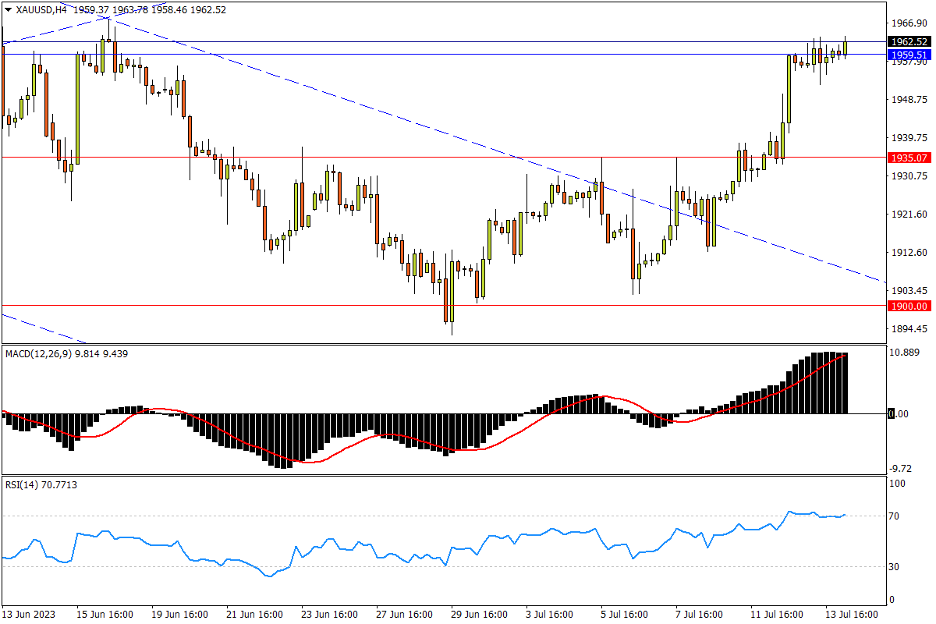

日线图看,周三(12日)大幅拉升后,金价隔夜升势放缓,仅微幅走高后,依然持于2月前高1959附近。走势来看,市场虽已上破冲关纪录高点失利后的下跌通道,但日线尚未打破下降常态,若无法站稳1959之上,市场仍有转跌风险。点位来看,短期复合头肩底颈线位1935(也是7月5日、7日高点)预计支撑牢固,若破则下行难免重测1900整数关附近的近期低位。指标方面,MACD快线持续回升即将收复零轴;RSI加速突入强势区,提示市场反弹强势依旧维系。

4小时图看,虽然先前金价短期波段底部不断抬高,但过去几个时段以来始终围绕1960一带窄幅横盘。上行潜力来看,多方新一轮攻势将剑指前期箱体上限1985至2000整数关口阻力,后者作为高位短期下降三角形底边位,预计抛压沉重。而在二次挑战2070历史高位之前,4月5日高点2030预计将率先阻拦多方攻势。指标方面,MACD快线在零轴上方升势放缓,存在形成死叉的趋向;RSI在超买线附近徘徊,提示金价面临微弱的回撤风险。

文章来源:FXTM富拓