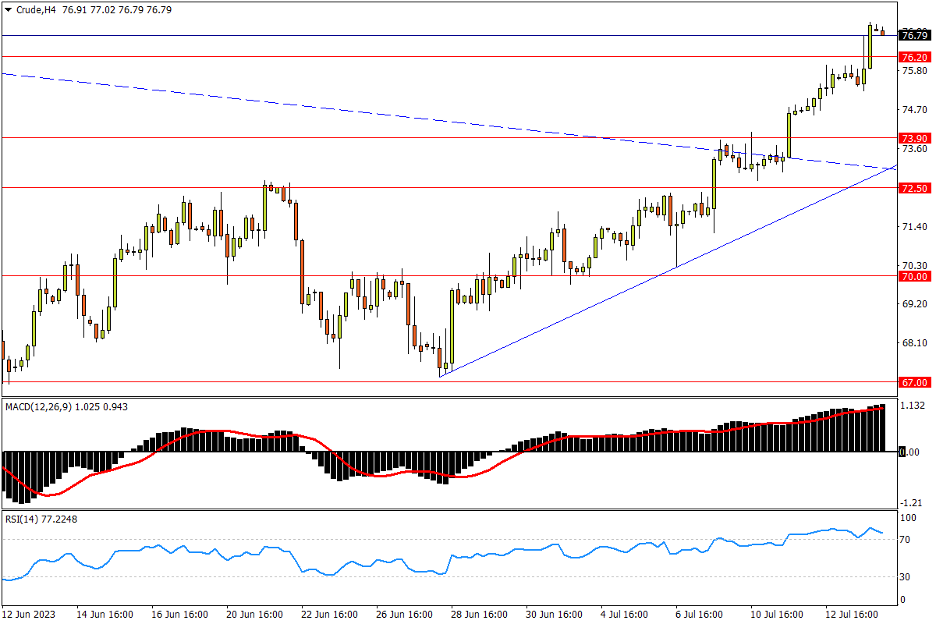

Chapter 20 07/14 CRUDE 多重利好下涨势提速,指标持续释放超买信号

上方阻力参考: 77.70、80.00、82.65

下方支持参考: 76.20、73.90、72.50

日线图看,除了加息预期的降温,利比亚油田因抗议活动停产的消息也为油价强势火上添油。美油上行已突入4月OPEC+突袭减产造成的大型缺口阻力区,上方2月14日低点77.70,以及缺口下沿的80关口将有明显抛压。若上行得以进一步突破1季度高位区域82.65至年内高点83.40的阻力带,则将确立中期底部。指标方面,MACD收复零轴后稳步攀升,且快慢线开口略有放大;RSI逼近超买线,一致呈现油价近期强势。

4小时图看,美油基于6月28日和7月6日低点的反弹有提速之势,但指标持续释放涨超信号:MACD不断攀升远离零轴;RSI持续固守超买区。回撤风险来看,4月低点73.90至前期箱顶74.70一带支撑相对关键,该位与短期升势下轨形成短期强弱分水岭,失守则市场多半将经历更深度调整。随后2月低点72.50若再失守,空方将夺回主导权,下行则剑指箱体价格中枢70关口(接近去年低点)。再往下,67的箱底位也是多方重要防线,跌破将很快滑向65一带年内低点。

文章来源:FXTM富拓