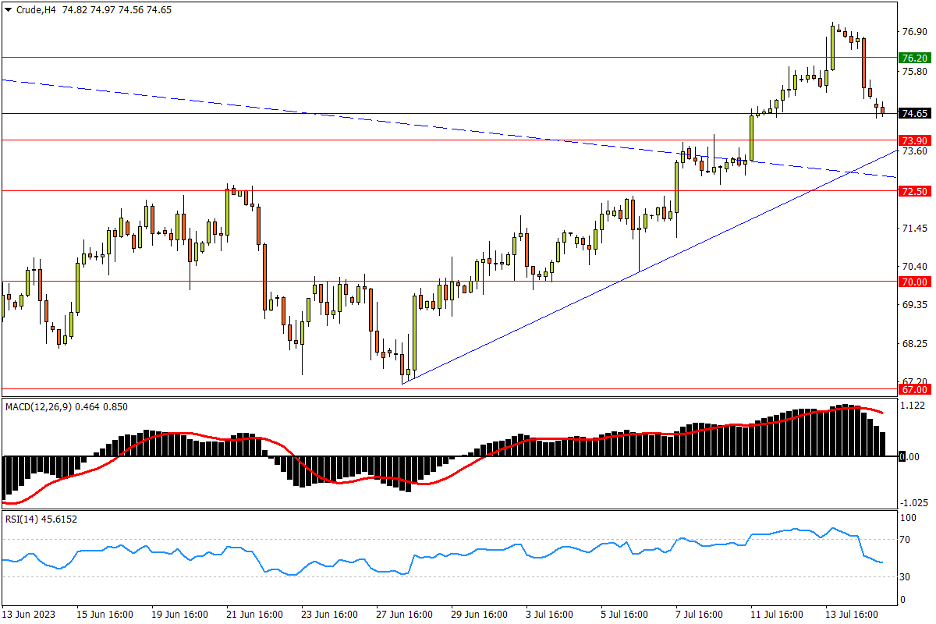

Chapter 22 07/17 CRUDE 缺口区域突遇结利压力,73.90附近支撑关键

上方阻力参考: 76.20、77.70、80.00

下方支持参考: 73.90、72.50、70.00

日线图看,美元和美债收益率回升的冲击下,国际原油受到明显的获利回吐压力。美油在4月大型缺口下沿附近收出吞噬阴线,给市场近来的凌厉反弹投下阴霾。回撤风险来看,4月低点73.90携手6月见底后形成的初始反弹通道下轨,构成重要支撑区域,跌破则短线趋势将转弱。随后2月低点72.50若再失守,空方将夺回主导权,下行还将剑指箱体价格中枢70关口(接近去年低点)。指标方面,MACD在紧贴零轴上方升势放缓;RSI逼近超买线后回落,提示油价冲高遇阻风险。

4小时图看,美油回撤尚未打破短线波段的上升常态,只要上述73.90支撑完好,市场仍有望重启升势。只是在OPEC+突袭减产造成的大型缺口阻力区内,上行在去年9月低点76.20,2月14日低点77.70,以及缺口下沿的80关口将遭遇一系列抛压。再往上,若进一步突破1季度高位区域82.65至年内高点83.40的阻力带,将可确立中期上攻基础。指标方面,MACD在远离零轴上方形成死叉,快线加速回撤;RSI同样跌破超买线后直线回落,提示市场短期见顶风险。

文章来源:FXTM富拓