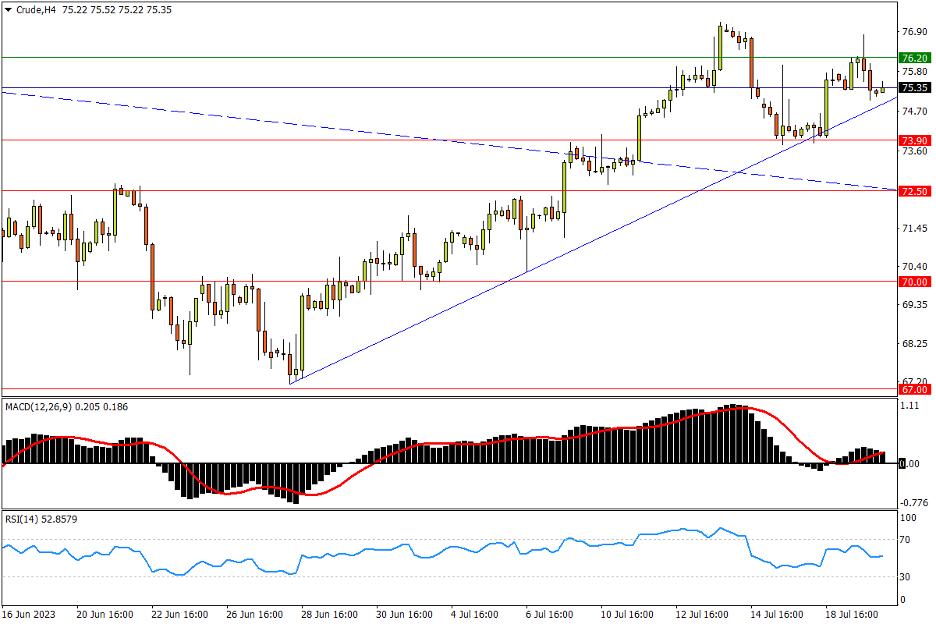

Chapter 28 07/20 CRUDE 面对缺口压力未战先怯,升势支撑能否止跌?

上方阻力参考: 76.20、77.70、80.00

下方支持参考: 73.90、72.50、70.00

日线图看,央行加息周期渐近尾声的利好并未能支撑油价涨势至隔夜最后一刻,美油在面对OPEC+“减产缺口”压力时未战先怯。收出小型倒锤线后,市场仍在竭力维护短期上升趋势。若通道支撑线及下方4月低点73.90先后跌破,空方将重新占据短期优势。随后2月低点72.50将有较强买盘承接力;再往下,70关口(接近去年低点)以及箱底位67.00均为关键支撑参考。指标方面,MACD快线在紧贴零轴上方走平;RSI在强势区止跌回稳,提示油价走势尚未明显转弱。

4小时图看,美油二次遇阻缺口压力后很快跌近不断上移的短期升势支撑线,多方仍有望在狭小范围内转守为攻。不过要强势突入缺口区域,市场或需得到供需关系趋紧的消息配合,从而更好地抵押去年9月低点76.20,2月14日低点77.70,以及缺口下沿的80关口等一系列抛压。随后1季度高位区域82.65至年内高点83.40的阻力带存在中期指向意义。指标来看,MACD在紧贴零轴上方接近死叉;RSI回撤跌近中性水平,双双给出行情转弱征兆。

文章来源:FXTM富拓