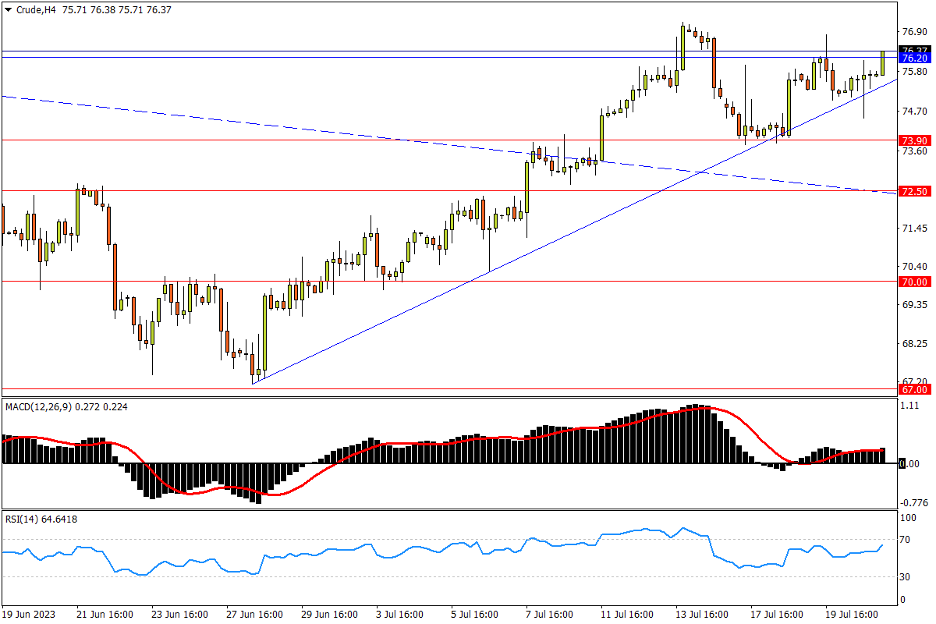

Chapter 30 07/21 CRUDE 嵌于两大关键位间,将做方向抉择

上方阻力参考: 77.70、80.00、83.40

下方支持参考: 73.90、72.50、70.00

日线图看,在短期反弹通道下轨一线,美油隔夜有惊无险地跌落回升,保留了对OPEC+“减产缺口”的威胁。但在两大关键技术水平之间,市场或将很快做出方向抉择。上攻潜能来看,多方将面临缺口内部的去年9月低点76.20,2月14日低点77.70,以及缺口下沿的80关口等一系列抛压。随后1季度高位区域82.65至年内高点83.40的阻力带的争夺将有中期指向意义。指标方面,MACD快线在紧贴零轴上方持续走平;RSI亦在强势区横向运行,同样提示油价或正酝酿方向突破。

4小时图看,美油隔夜抵御住空方下测短期通道支撑的攻势,但过去一周多来在缺口压制下始终显得关前情怯。若通道下轨失守,则紧接着空方将向4月低点、过去两个月的箱体上限73.90寻求支撑;该位若破,在形成短期头部形态的同时也将打破波段上升常态。随后2月低点72.50,70关口(接近去年低点)以及箱底位67.00依次为后续重要支撑参考。指标来看,MACD在零轴上方走平,快慢线互相纠结;RSI在强势区震荡,提示短期反弹势头正直面考验。

文章来源:FXTM富拓