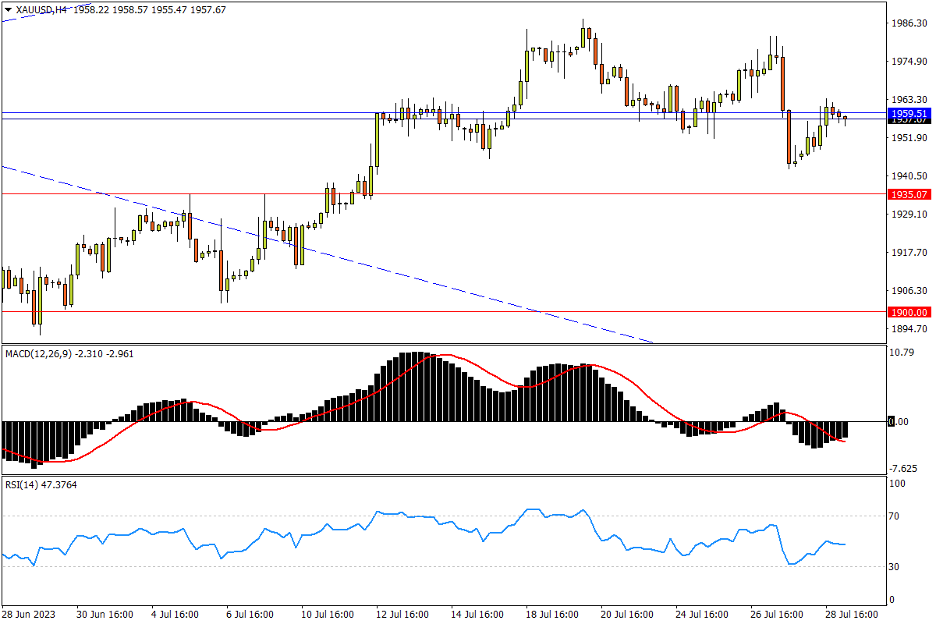

Chapter 41 07/31 XAU/USD 面对强阻振幅加剧,1960成涨跌分水岭

上方阻力参考: 1959、1985、2000

下方支持参考: 1935、1900、1877

日线图看,因上周中美联储决议影响持续发酵,美元和美债收益率回落助力金价于周末前反弹,但整体不改近日围绕2月高点1959关键位震荡的格局。若重新站稳该位上方,则仍有望重启月初见底后升势;但上行即将遭遇5-6月箱体上限1985至2000关口一带顽阻。突破后者,多方将重塑冲关历史高点2070的通道,而之前将首先遭遇4月5日高点2030附近抛压。指标方面,MACD在零轴上方死叉后走平;RSI震荡下行未破强势区,记录金价消化前期反弹升势的过程。

4小时图看,金价在反弹逼近1960及上方潜在阻力区时振幅明显加剧,且已形成即期波段顶底缓慢下移的下降常态。尤其是若当前反弹无法攻破前者,金价恐将现“更低高点”。后续下行风险来看,小型复合头肩底颈线位1935(7月5日高点,也接近5月低点区域)一带支撑显得格外重要,失守则难得聚拢的做多人气将遭重创,空方也将再次考验1900下方的近期低位。指标方面,MACD在零轴下方再次温和金叉;RSI反弹升至中性水平弱侧,呈现即期震荡反复的行情。

文章来源:FXTM富拓