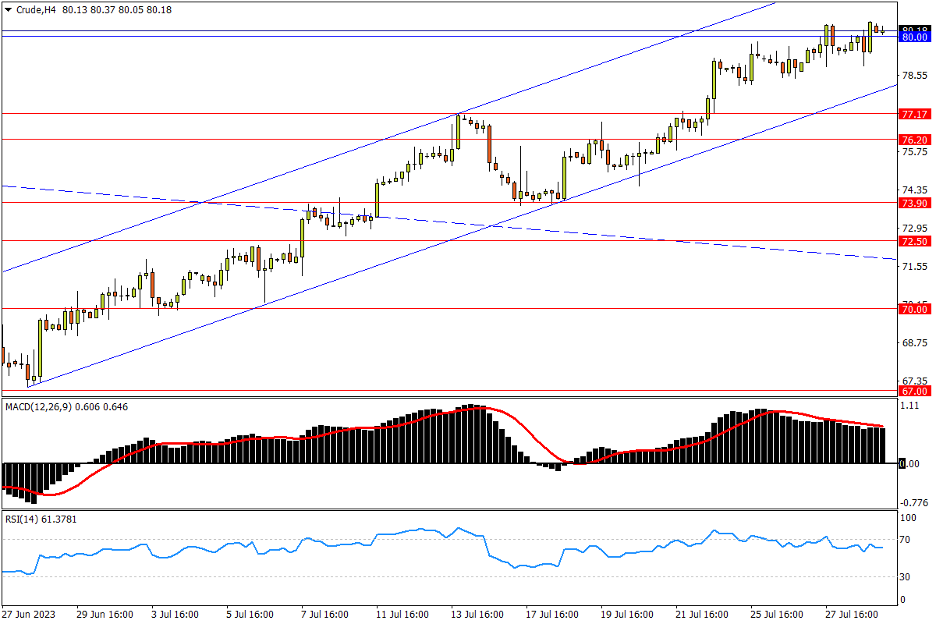

Chapter 42 07/31 CRUDE 80附近升势放缓,回撤关注通道支撑

上方阻力参考: 82.65、83.40、85.40

下方支持参考: 77.17、76.20、73.90

日线图看,供应端产出受限,经济向好又有助需求,美油上周末段攻破80关口。走势来看,油价仍稳定处在6月底起涨以来的升势通道中,但过去一周来,市场升势在80附近明显放缓。另一方面,多方也需在打响1季度高位82.65至年内高点83.40阻力区决战之前夯实冲关基础。突破则油价将完成中期大底的构筑,随后去年8月低点85.40预计也将有温和抛压。指标方面,MACD在零轴上方持续攀高;RSI贴近超买线后小幅震荡,彰显油价依然延续温和强势。

4小时图看,美油周初似乎仍未摆脱80关口的牵引,已微幅回落逼近该位。下行风险来看,伴随着短期上升通道下轨上移,多方亟需再次发力以维系现有攻势节奏。失守则市场将再次回到4月OPEC+意外减产形成的大型缺口中展开拉锯。但预计7月13日高点77.17,以及去年9月低点76.20等缺口内支撑将买盘踊跃。失守则市场趋势将转弱。后续下行将依次指向5-6月震荡箱体上限73.90。指标方面,MACD在零轴上方死叉后缓步回落;RSI在零轴下方震荡横盘,警示市场涨势已放缓。

文章来源:FXTM富拓