Chapter 2 08/01 CRUDE 供给收紧助推升势,更为逼近中期强阻

上方阻力参考: 82.65、83.40、85.40

下方支持参考: 80.00、77.17、76.20

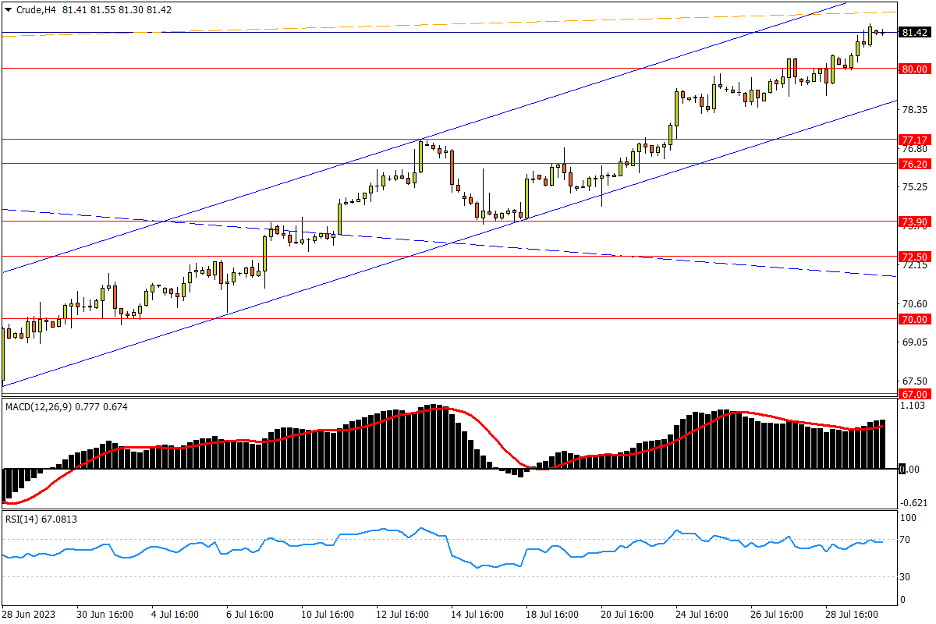

日线图看,调查显示7月OPEC石油产量创近2年新低,助推油价延续近期升势。走势来看,日线再拔三连阳后,美油有力地延续着6月底起涨后的升势。不过伴随着价格更为逼近1季度高位82.65至年内高点83.40阻力区,不排除后续行情振幅加剧的风险。后者若破则将开启中期上档空间,之后去年8月低点85.40,去年7月低点88.33均为阻力参考。指标方面,MACD在零轴上方持续攀高;RSI升入超买区后止步,彰显油价强势的同时也在发出涨超预警。

4小时图看,美油很快完成在80一带的蓄势整理,该位当前也转而成为至关重要的下档支撑。一旦跌破,油价或将紧接着下测6月起涨以来的初始上升通道下轨,同时重新跌回4月OPEC+意外减产形成的大型缺口中。但预计7月13日高点77.17,以及去年9月低点76.20等缺口内支撑将买盘踊跃。悉数失守后市场趋势将彻底转弱,后续支撑将指向5-6月震荡箱体上限73.90。指标方面,MACD在远离零轴上方形成金叉;RSI缓步回升再度逼近超买线,凸显市场即期强势。

文章来源:FXTM富拓