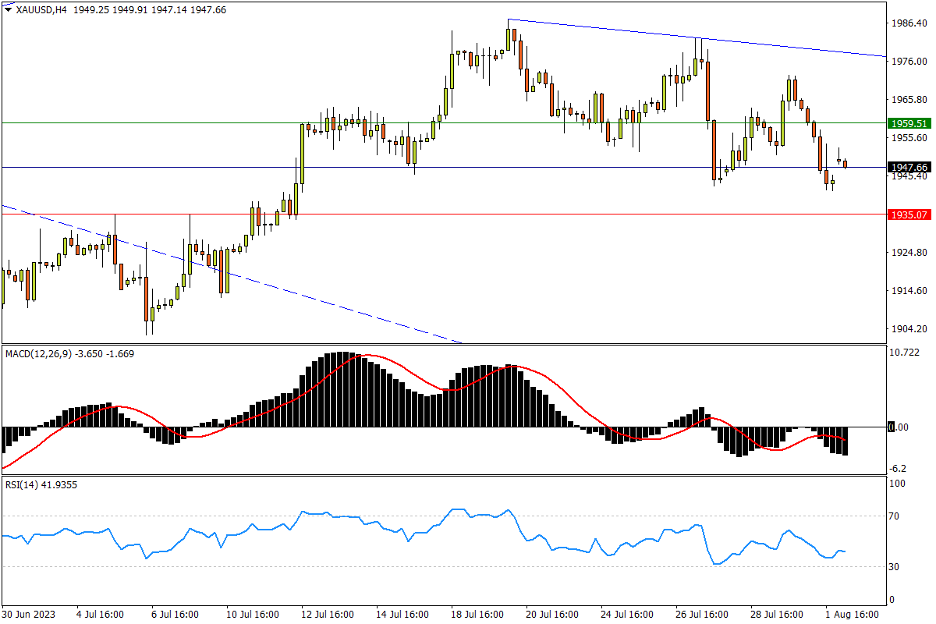

Chapter 3 08/02 XAU/USD 震荡下行刷新3周低位,多方亟需固守“颈线位”

上方阻力参考: 1959、1985、2000

下方支持参考: 1935、1900、1877

日线图看,隔夜美元及美债收益率走强令现货金承压创下3周新低,但惠誉下调美国评级激发避险情绪,周三(2日)盘初小幅高开。走势来看,金价依旧以2月高点1959为轴心展开震荡,且重心略有下移。多方当务之急是固守小型复合头肩底颈线位1935(7月5日高点,也接近5月低点区域)一带支撑。失守则将打击难得聚拢的做多人气,随后将紧接着考验1900下方的近期低位。指标方面,MACD在零轴上方形成死叉;RSI震荡下行来到中性区域,记录金价渐失上行动能的过程。

4小时图看,金价过去两周呈宽幅震荡下行态势,即便跌速较缓,但也在明示上方5-6月箱体上限1985至2000关口强阻的顽固程度。上涨潜能来看,多方首先需攻上1959以站稳脚跟,随后2000下方的决战将决定市场中短期运行方向;一旦上破,多方有望开启再战2070下方纪录高点的通道,但此前将首先遭遇4月5日高点2030附近抛压。指标方面,MACD在零轴下方反复交叉,但整体呈横向窄幅震荡;RSI仍在弱势区徘徊,提示市场处于弱均衡态势。

文章来源:FXTM富拓