Chapter 4 08/02 CRUDE 攻势不减贴近中期强阻,“上吊线”流露整固需求

上方阻力参考: 82.65、83.40、85.40

下方支持参考: 80.00、77.17、76.20

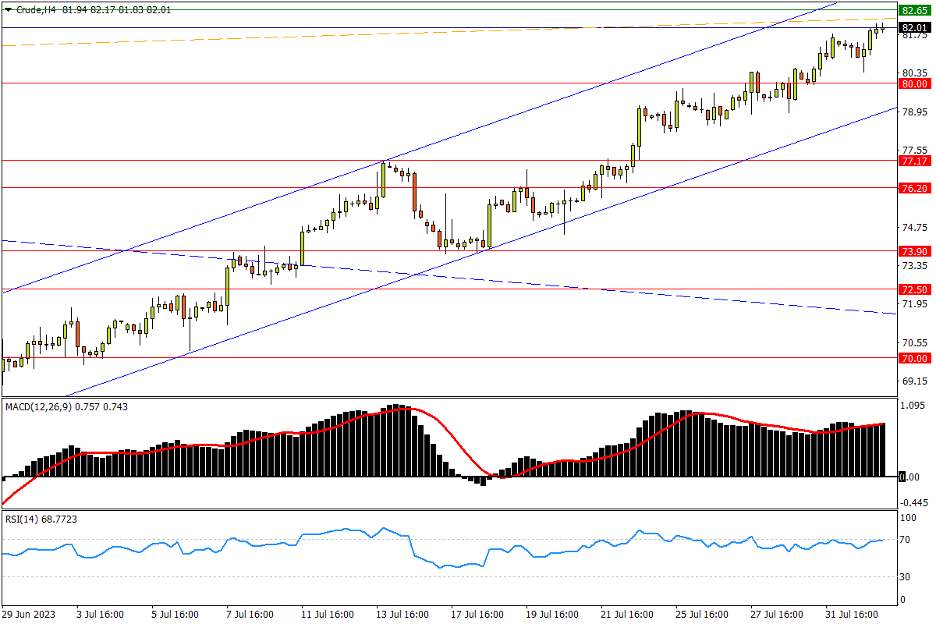

日线图看,油价隔夜涨势一度遭遇结利压力,但供需形势持续收紧的环境令市场轻易收复盘中跌幅。但日K线吊颈线模式仍在流露上行遇阻风险,尤其是在越发逼近1季度高位82.65至年内高点83.40强阻区域的情况下;另一方面,市场也有必要整固消化贯穿整个7月的反弹升势。一旦站上83.40,则将开启中期上行空间,之后去年8月低点85.40,去年7月低点88.33均为阻力参考。指标方面,MACD在零轴上方维系升势;RSI固守超买区,提示强势的同时发出涨超警告。

4小时图看,美油7月以来的震荡升势始终完好,潜在回撤只要固守80上方,则依旧有望继续为冲关中期强阻蓄势。但若连同近期升势通道下轨一并跌破,则市场或将开启久违调整。跌回4月OPEC+意外减产形成的大型缺口后,预计7月13日高点77.17,以及去年9月低点76.20等支撑将买盘踊跃。再往下,5-6月震荡箱体上限73.90预计也有相当承接力。指标方面,MACD在远离零轴上方走平,快慢线持续粘连;RSI在紧贴超买线下方横盘,提示现有强势稳固。

文章来源:FXTM富拓