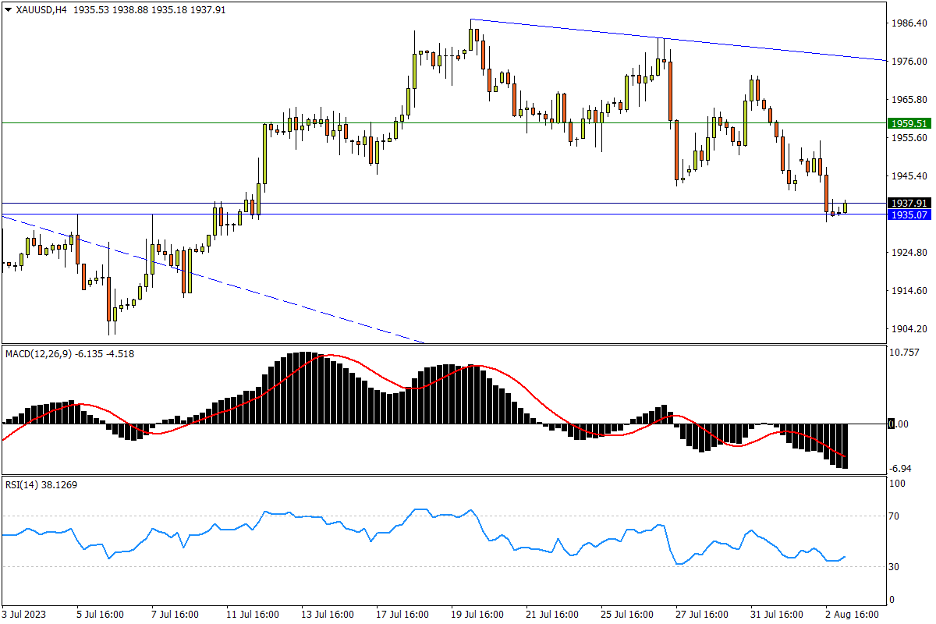

Chapter 5 08/03 XAU/USD 下行暂止于颈线支撑,1935争夺将决断后市方向

上方阻力参考: 1959、1985、2000

下方支持参考: 1935、1900、1877

日线图看,美元及美债收益率走强的利空影响明显盖过避险情绪,金价两日连跌后已逼近前期小型复合头肩底颈线位1935(7月5日高点,也接近5月低点区域),该位失守意味着市场可能在7月已现日线波段的“更低高点”(1987),空方也将紧接着重测1900下方的6月谷底。再往下,去年6月高点1877至3月6日高点1858料有买盘承接力。指标方面,MACD在零轴上方形成死叉;RSI震荡下行跌入弱势区,提示金价趋势处在强弱转换的关键期。

4小时图看,金价宽幅震荡进一步打出下行空间,1935作为过去两个多月的高低点成交密集区,争夺结果很有可能决定市场方向。反弹机会来看,2月高点1959也是阻止多方攻势的潜在障碍,站上将暂缓现有下行压力。再往上还将遭遇5-6月箱体上限1985至2000关口强阻区域,唯破后者方可重启挑战纪录高点的通道。指标方面,MACD在零轴下方跌势提速;RSI逼近超卖线后走平,均呈现市场弱势。

文章来源:FXTM富拓