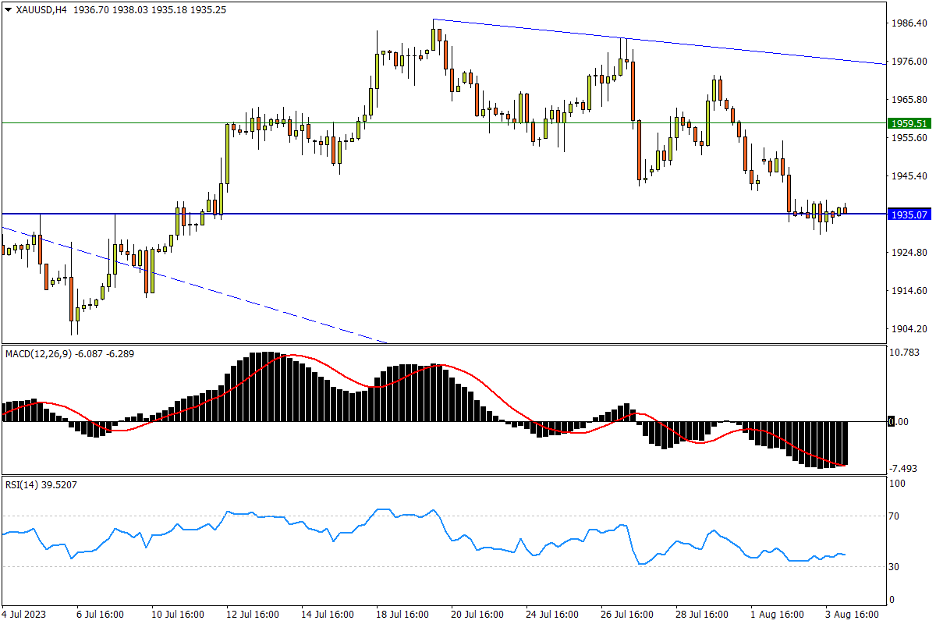

Chapter 7 08/04 XAU/USD 颈线支撑附近窄幅波动,关键位间料仍有震荡

上方阻力参考: 1959、1985、2000

下方支持参考: 1935、1900、1877

日线图看,金价隔夜微幅震荡走平,虽然美元回落,但中长期美债收益率上行形成压制。市场依然在前期小型复合头肩底颈线位1935(7月5日高点,接近5月低点区域)附近徘徊,延续着7月20日遇阻回落后的弱势。该位若失,意味着市场可能在7月已现日线波段的“更低高点”(1987),空方也将紧接着重测1900下方的6月谷底。再往下,去年6月高点1877至3月6日高点1858料有买盘承接力。指标方面,MACD快线下行跌穿零轴;RSI于弱势区走平,提示金价趋势转弱。

4小时图看,金价几个时段以来限于十分狭小的区间内震荡,1935虽然暂时遏制下行跌势,但多头也无组织反攻之意。对于多方而言,在1900关键位上方几无险可守,然而潜在上行却很快将面对2月高点1959阻力,随后还将遭遇5-6月箱体上限1985至2000关口强阻区域。唯有悉数突破方可重启挑战纪录高点的通道。指标方面,MACD在零轴下方形成温和金叉;RSI在超卖线上方微幅回升,仍呈现市场相对弱势。

文章来源:FXTM富拓