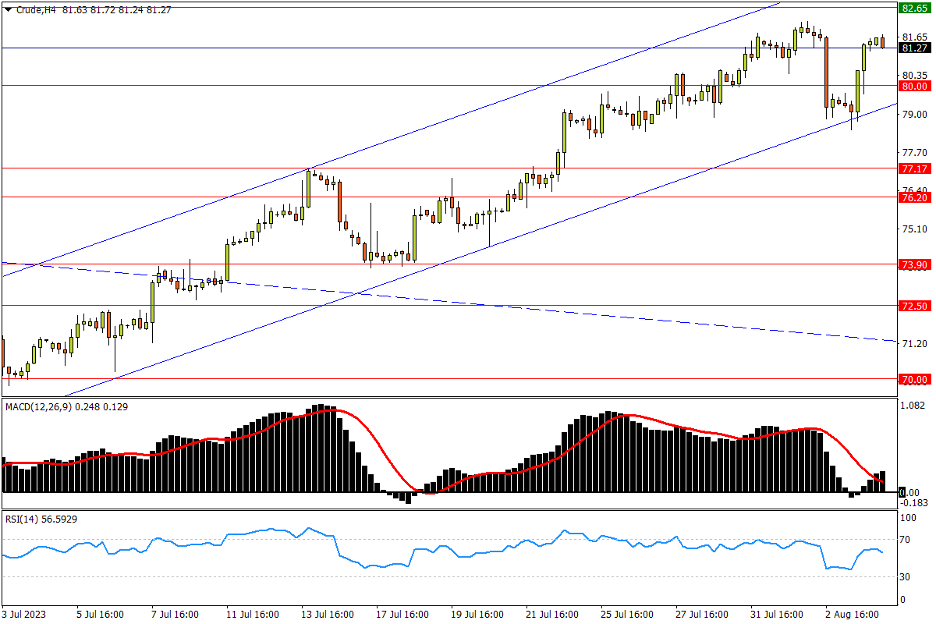

Chapter 8 08/04 CRUDE 借力通道下轨反弹,中期强阻依然施压

上方阻力参考: 82.65、83.40、85.40

下方支持参考: 80.00、77.17、76.20

日线图看,沙特和俄罗斯均表态延长减产计划,油价隔夜于关键的趋势支撑附近大幅反弹,并大部分收复周三(2日)录得的中阴跌幅。多方目前再次瞄准1季度高位82.65至年内高点83.40阻力区域,预计上探过程将遭遇沉重抛压。站上后者,市场将开启后续中期上行空间,随后去年8月低位区域85.40,去年7月14日低点88.33亦为阻力参考。指标方面,现价回升令MACD暂时规避死叉命运;RSI依然上逼超买线,提示油价仍保留相对强势。

4小时图看,再次验证6月底以来的升势下轨支撑效力后,美油强势仍在延续。然而在上述阻力区未破的情况下,下行风险同样未能“根除”。支撑则继续紧盯80关口和通道下轨,跌破将回到OPEC+意外减产形成的大型缺口内部。预计其中7月13日高点77.17,以及去年9月低点76.20等点位将有踊跃买盘。随后5-6月震荡箱体上限73.90也有相当承接力。指标方面,MACD在紧贴零轴上方形成金叉;RSI重回强势区,呈现即期凌厉的反攻势头。

文章来源:FXTM富拓