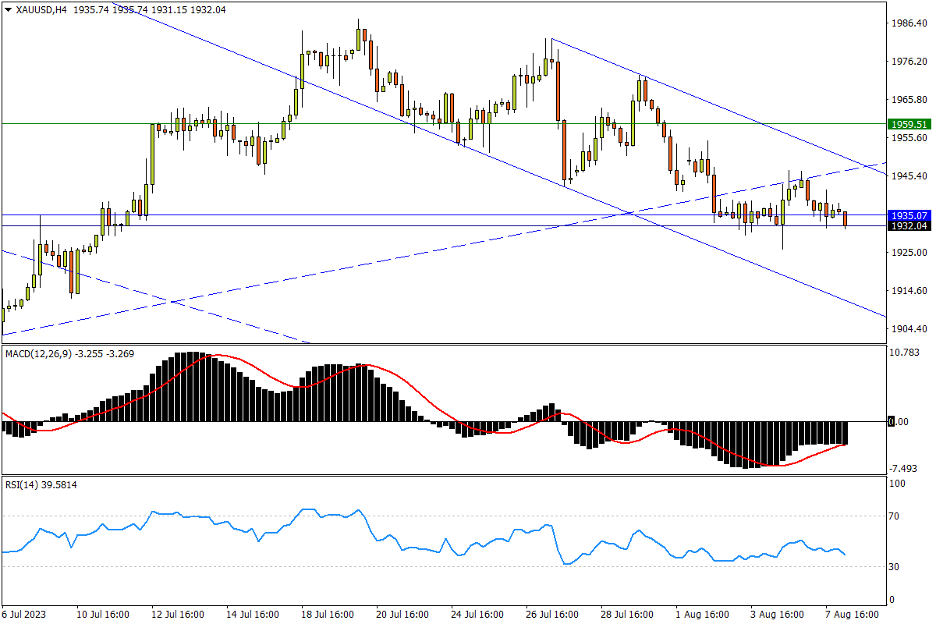

Chapter 11 08/08 XAU/USD 难逃颈线位“引力”,有待打破弱均衡态势

上方阻力参考: 1959、1985、2000

下方支持参考: 1935、1900、1877

日线图看,黄金再次受美元和长端美债收益率携手走高的压制,多空双方针对前期小型复合头肩底颈线位1935(7月5日高点,接近5月低点区域)关键支撑的争夺依然千钧一发。一旦跌破,下行将极易再测1900整数位(接近6月低点)支撑强度,该位再失则将开启更大中期下档空间。预计下方去年6月高点1877至3月6日高点1858将有持续的买盘承接力。指标方面,MACD快线率先跌破零轴;RSI于弱势区走平,提示金价趋势逐渐转弱。

4小时图看,金价隔夜回撤恐再次形成波段更低高点,多方唯有力守1935不破以止颓势。然而上行也将很快遭遇短期下降通道上轨和2月高点1959的轮番阻力。突破后者,多头将继续重新挑战5-6月箱体上限1985至2000关口强阻区域。后者也是市场重新上看2070历史高点的门槛位,此前5月上旬低点2030亦有抛压驻守。指标来看,MACD快线在零轴下方逐渐走平,且有形成死叉的迹象;RSI在弱势区震荡后走平,呈现市场短暂处于弱平衡状态。

文章来源:FXTM富拓