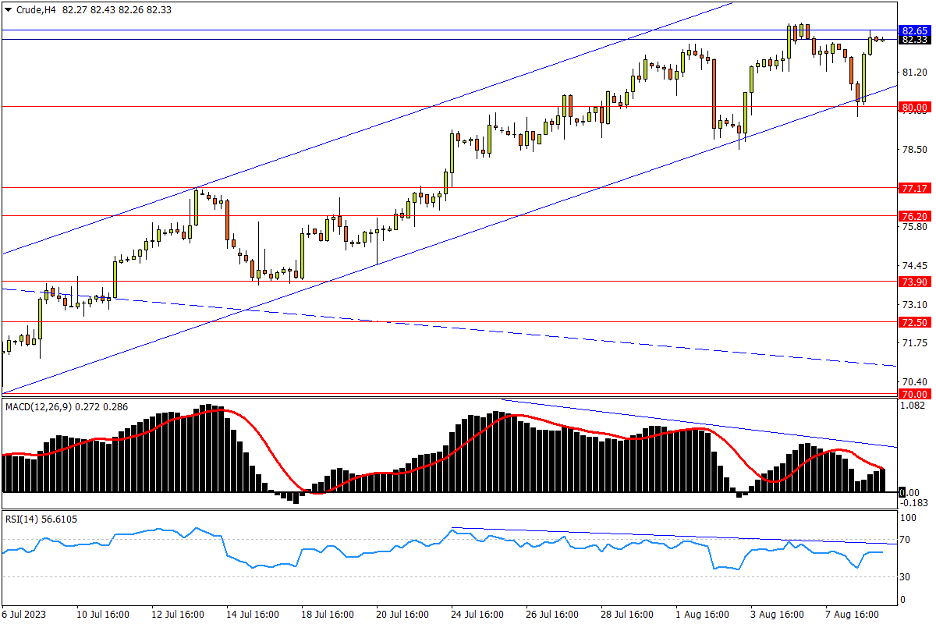

Chapter 14 08/09 CRUDE 下测80支撑后V形反转,指标持续背离需警惕

上方阻力参考: 82.65、85.40、88.33

下方支持参考: 80.00、77.17、76.20

日线图看,亚洲各国贸易数据疲软加重需求担忧,一度压制美油下测80整数关口,但多方在该位至7月来涨势通道下轨支撑骤然发力,7月OPEC+产量下降等利好消息也为反弹推波助澜。然而仍需警惕市场在中期阻力下方收出的吊颈线,后市唯破1季度高位82.65至年内高点83.40阻力区方可确认开启更大上行空间。随后去年8月低位区域85.40,去年7月14日低点88.33料亦有抛压驻守。指标方面,MACD在零轴上方即将死叉;RSI于紧贴超买线下方走平,提示高位遇阻风险。

4小时图看,美油近日两次测试上升通道下轨均走出强力的V形反转,凸显多头阻跌意愿。然而在空方间或发力的同时,技术指标也出现了涨势力竭的信号:MACD和RSI的波段高点持续下移,与现价连创新高的态势相悖。一旦上述80关口至通道下轨构成的关键支撑失守,此前延续许久的升势节奏将被打破。而在下方“减产缺口”内部,7月13日高点77.17,以及去年9月低点76.20等点位料有踊跃买盘。随后5-6月震荡箱体上限73.90也有相当的买盘承接力。

文章来源:FXTM富拓