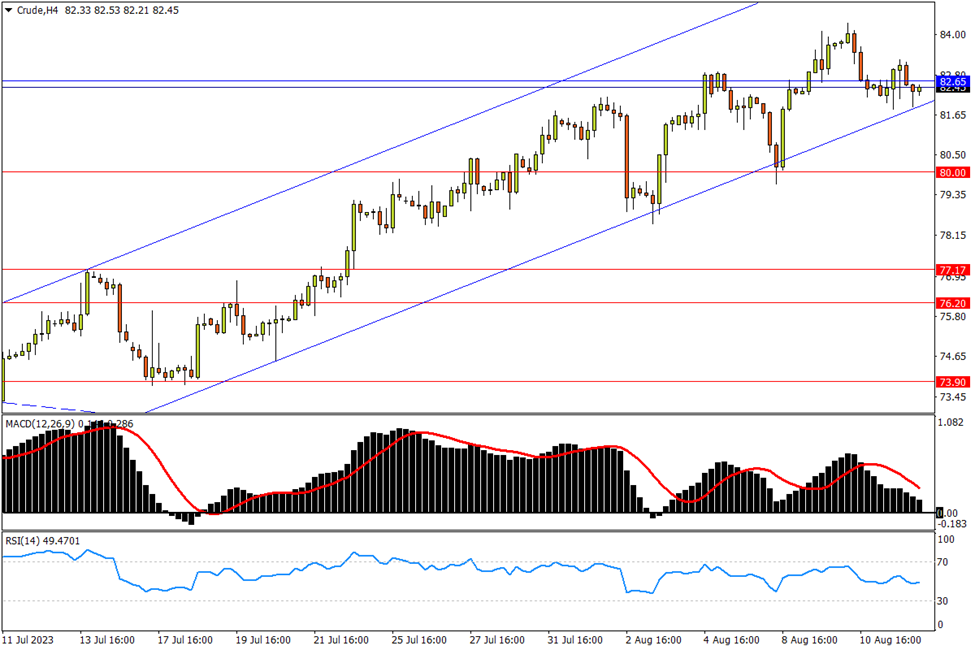

Chapter 20 08/14 CRUDE 三次回探通道下轨,短期再遇方向抉择

上方阻力参考: 85.40、88.33、92.29

下方支持参考: 80.00、77.17、76.20

日线图看,国际能源署(IEA)下调原油需求预估令近期处于强势的油价略为承压,美油周初正下测6月底以来形成的狭窄上行通道下轨,且已是本月第三次。若下行最终跌破,则市场一方面将打散过去一个半月的上行势节奏,同时也将暂时跌离1季度高位82.65至年内高点83.40的关键阻力区。由此开启的调整势头将很快下测80整数关口,随后“减产缺口”也将进入空方攻击范围。指标方面,MACD形成死叉后温和走低;RSI触及超卖线后略有回撤,提示市场短期见顶风险。

4小时图看,美油再度下探通道下轨支撑,但在该技术水平仍有明显多头力量涌现,固守则依然将继续向上挑战年内高点83.40,并延续通道内强势。后续上行目标来看,去年8月低位区域85.40,去年7月14日低点88.33预计也均有明显抛压。再往上,去年3月低点/10月反弹高点区域92.29为又一大中期强阻。指标方面,多方需警惕的是,MACD在零轴上方形成鸭张嘴的跌势加速信号;RSI回撤跌至中性水平强侧,暗示市场或正处在短期多空转换节点。

文章来源:FXTM富拓