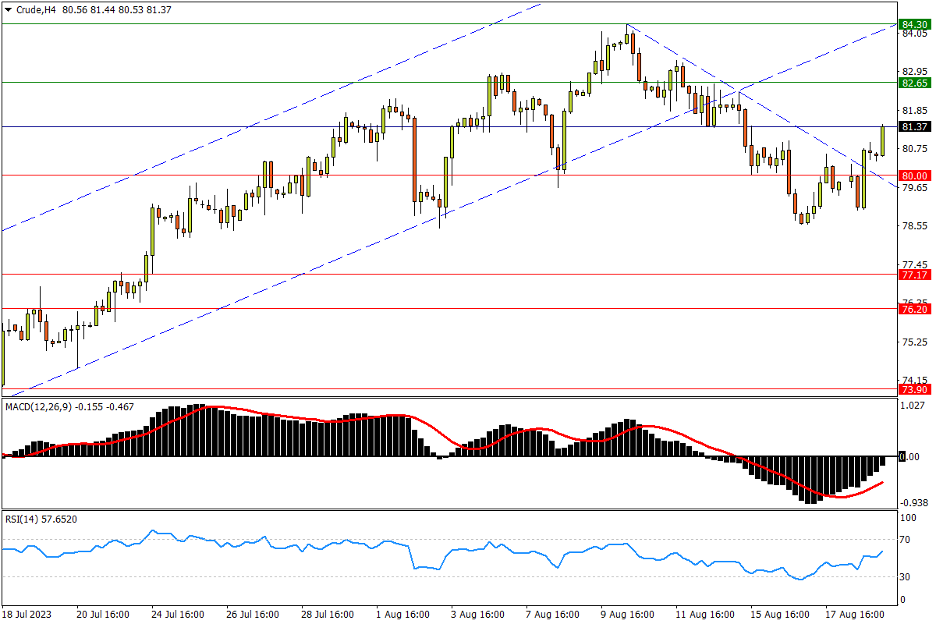

Chapter 30 08/21 CRUDE 力守80关口不破,反弹突破短期调整压力

上方阻力参考: 82.65、84.30、85.40

下方支持参考: 80.00、77.17、76.20

日线图看,在需求前景担忧的压制下,油价上周前半段连跌三日,但原油多头之后并未轻易弃守80关口。可见在该位下方的4月大型“减产缺口”有着较强的买盘承接力,且其间7月13日高点77.17,以及去年9月低点76.20等也都是值得关注的潜在支撑。若缺口依然被悉数回补,则下方5-6月箱体上限73.90至1-2月低点72.50仍将形成稳固的支撑带。指标方面,MACD死叉后快线跌势略有放缓;RSI跌近中性区域后回升,提示油价调整已遇多方承接。

4小时图看,美油几个时段以来围绕80关口展开反复争夺,且上周末段冲破8月10日以来的调整通道上轨,存在一定重启升势的迹象。不过上行也将面临一系列强阻:1季度高位82.65至年内高点83.40一带难免遭遇持续抛压,随后去年8月低位区域85.40料亦有顽固阻力;冲破后者市场将开启更大上行空间。指标来看,MACD金叉后快线加速升向零轴;RSI自触及超卖线后持续震荡攀升进入强势区,凸显油价短期转强可能。

文章来源:FXTM富拓