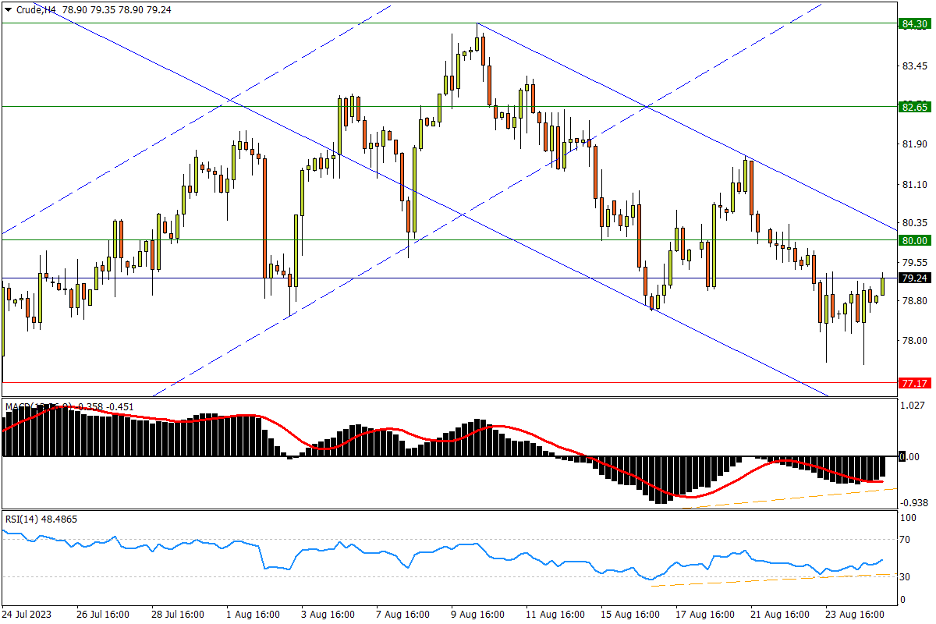

Chapter 38 08/25 CRUDE 缺口上端双针探底,引燃攻击双重短阻希望

上方阻力参考: 80.00、82.65、84.30

下方支持参考: 77.17、76.20、73.90

日线图看,花旗分析料OPEC+可能进一步减产,盘中数次下探的油价最终惊险反弹,小涨中断此前的三连阴。不过美油整体仍处在本月10日见底后形成的小型跌势通道中,而隔夜的锤头线有望燃起上试80关口与短期跌势上轨交汇形成的阻力区的希望。突破则将重新上演上试连番阻力的戏码:首先1季度高位82.65至年内高点83.40一带料有持续抛压,随后去年8月低位区域85.40亦有顽阻,再破则开启中期升势空间。指标方面,MACD和RSI分别跌近零轴和中性区,记录涨势退潮过程。

4小时图看,美油过去两日在4月减产缺口上端出现“双针探底”的见底迹象;与此同时,MACD和RSI最近的波段底部抬高,与现价方向相悖发出底背离信号,为多方冲击上述阻力增添砝码。但在80关口下方,空头仍有随时发力的潜质,尤其是全球经济复苏明显受限,从而制约燃料需求前景的情况下。潜在支撑先看7月13日高点77.17一线支撑,紧接着去年9月低点76.20也将有买盘承接力。若下行完全回补上述缺口,更多支撑可参考5-6月的箱体上限73.90。

文章来源:FXTM富拓