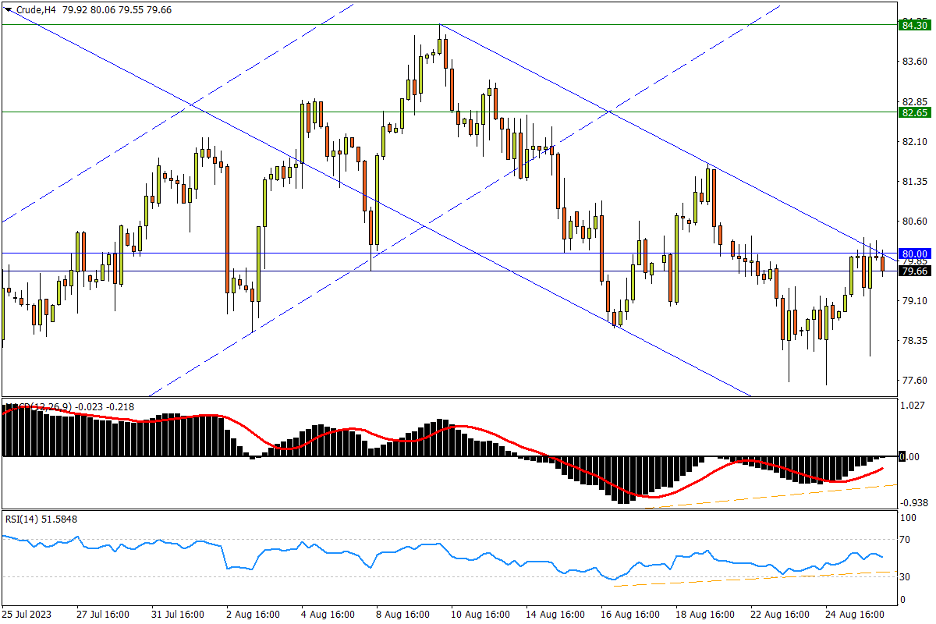

Chapter 40 08/28 CRUDE 震荡回升再临80关口,冲破有望重启升势

上方阻力参考: 80.00、82.65、84.30

下方支持参考: 77.17、76.20、73.90

日线图看,原油在鲍威尔发表鹰派言论后一度大幅回落,但之后其“谨慎”的加息姿态被市场深入解读,因此美油上周收盘前重返日内高位。与此同时,上行已再次直逼80关口与短期跌势上轨交汇形成的阻力水平。一旦突破,多方在打破近期跌势的同时,也将摆脱4月减产缺口的牵引。然而后续上行将在1季度高位82.65至年内高点83.40一带遭遇持续抛压,随后去年8月低位区域85.40亦有顽阻。指标方面,MACD和RSI均有固守强势区临界点的迹象,呈现市场返强信号。

4小时图看,美油上周后半段连续三次在缺口中的支撑区域上方形成探针形态,凸显多方阻跌决心。同时指标的底背离迹象也助长了市场短线反弹势头,当前80一带争夺将定后市方向。但若全球经济疲弱预期始终施压,市场恐难免重返弱势。潜在支撑先看7月13日高点77.17一线支撑,紧接着去年9月低点76.20也将有买盘承接力。若下行完全回补减产缺口,更多支撑可参考5-6月的箱体上限73.90。指标方面,MACD快线接近收复零轴;RSI震荡跃入强势区,呈现市场复苏迹象。

文章来源:FXTM富拓