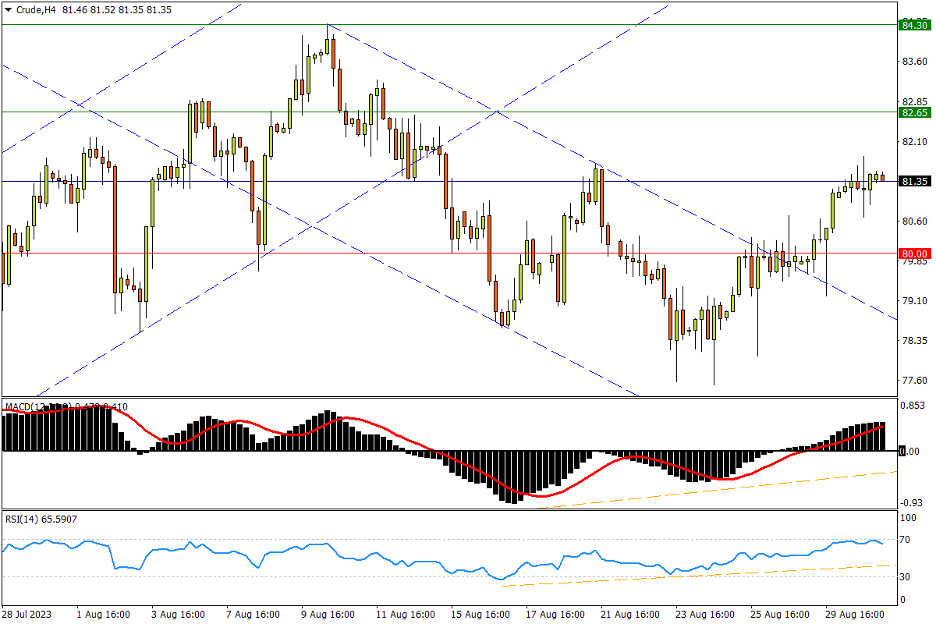

Chapter 46 08/31 CRUDE 供应收紧提供有力支撑,上行将战8月高位区域

上方阻力参考: 82.65、84.30、85.40

下方支持参考: 80.00、77.17、76.20

日线图看,美国燃料库存大降,沙、俄继续减产决心坚定,油价延续近日反攻势头。市场短期格局未变,上行已更为贴近1季度高位82.65至年内高点84.30一带阻力区。若破还将进一步遭遇去年8月低位区域85.40附近抛压,站上方可进一步开启中期强势。随后去年7月低点88.33,以及去年3-4月双底下限92.29均为中期重要阻力参考。指标方面,MACD在零轴上方接近形成金叉;RSI在强势区延续升势,记录价格近期转强过程。

4小时图看,美油向上摆脱80关口后固守涨幅,尤其是29日一度回踩已突破的短期跌势上轨后形成锤头线,出现新的波段低位;只要80关口至该位支撑不破,则市场涨势基础依然完好。但若失守,空方或将再次测试近期低位,随后在4月OPEC+“减产缺口”内部,7月13日高点77.17与去年9月低点76.20将有更为明显的支撑力量。指标方面,MACD在零轴上方延续温和涨势;RSI上行贴近超买区,一致呈现油价短线强势。

文章来源:FXTM富拓