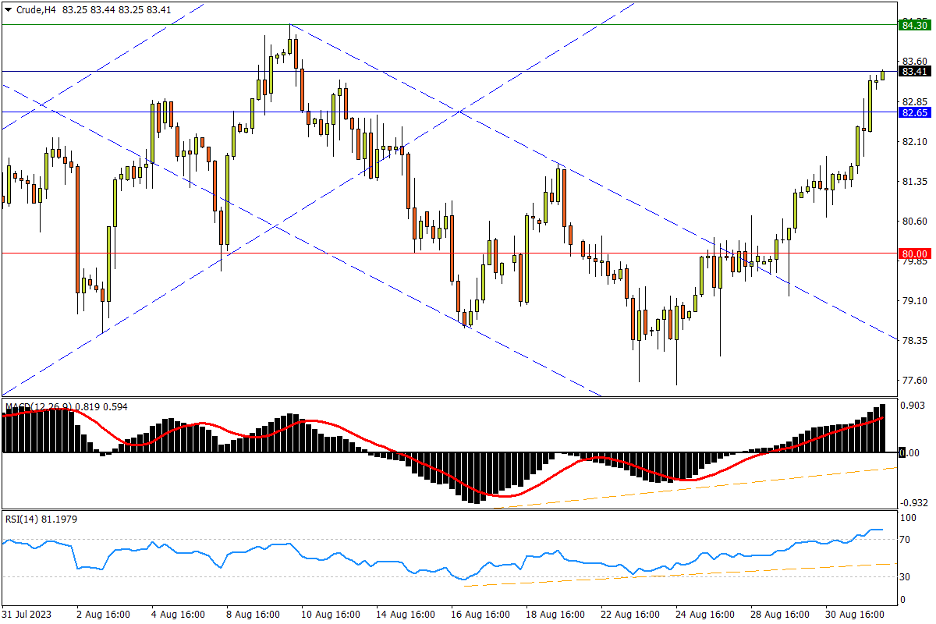

Chapter 2 09/01 CRUDE 减产行动助推升势,构筑大底还差临门一脚

上方阻力参考: 84.30、85.40、88.33

下方支持参考: 82.65、80.00、77.17

日线图看,美油隔夜持续大涨突入强阻区域,俄罗斯同意进一步削减石油出口,同时沙特的“自愿减产”继续延长。点位来看,油价隔夜站上1季度高位82.65后,将继续挑战年内高点84.30,以及去年8月低位区域85.40两大阻力。若悉数突破,市场中期大底将构筑完毕。后续上行目标将锁定去年7月低点88.33,以及去年3-4月双底下限92.29。指标方面,MACD在零轴上方形成金叉;RSI持续上行逼近超买线,呈现油价近日凌厉的上攻势头。

4小时图看,美油上破82.65同时刷新三周新高是市场强势明证,只要价格固守该位上方,多方将手握继续冲击连番强阻的主动权。但若失守,则至少面临蓄势整固的需要,后续支撑重点关注80关口。该位再破,油价将失去8月下旬低位前的一道重要屏障,也将成为短期趋势再度转弱的起点。随后减产缺口中的7月13日高点77.17、去年9月低点76.20亦为支撑参考。指标方面,MACD在零轴上方出现“鸭张嘴”的上行提速信号;RSI深入超买区,涨超迹象同样提示整理蓄势的必要。

文章来源:FXTM富拓