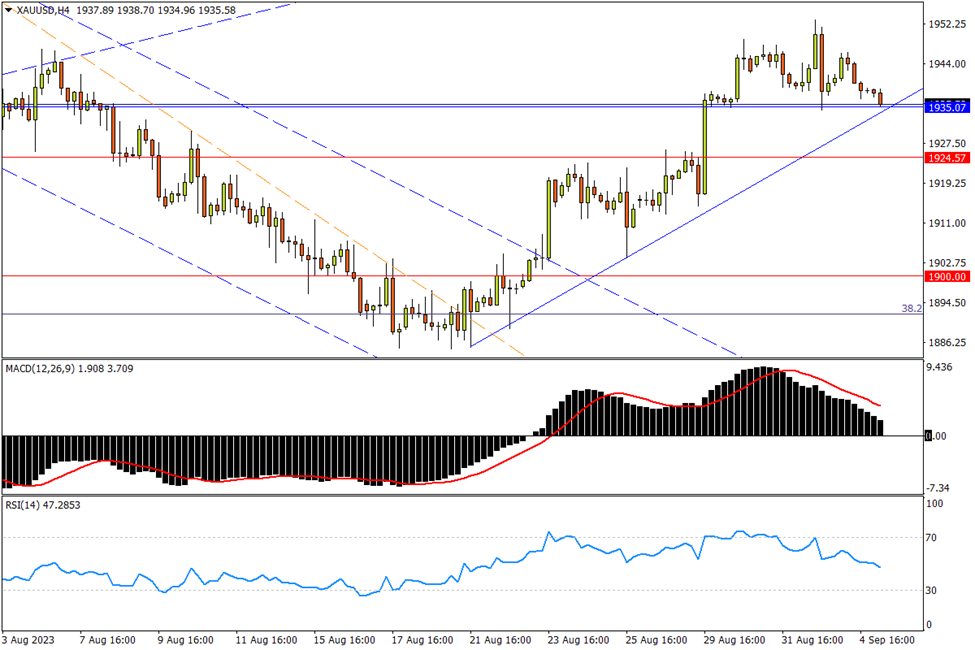

Chapter 5 09/05 XAU/USD 振幅收敛收出孕线,1935决战即将打响

上方阻力参考: 1959、1985、2000

下方支持参考: 1935、1900、1877

日线图看,金价继上周五(1日)收出射击之星后,隔夜再现一根波幅收敛的孕线,美国劳动节休市加剧了市况的冷清。但正如此前提示,市场关键支撑区域:6-7月小型头肩底颈线位1935(7月5日高点,接近5月低点区域)与8月下旬新一轮反弹起势后的初始支撑线正面临空方考验。一旦跌破,市场将再度面临延续日线波段下跌常态的风险。6月15日低点1924,1900关口均为后续支撑参考。指标方面,MACD快线收复零轴后上行步伐放缓;RSI在强势区微跌,记录金价涨势停滞的过程。

4小时图看,现货金在1935支撑附近将打响判定短期方向的决战,若多方力守不破,则金价震荡反弹的势头将延续。上行首先指向2月高点1959一带强阻,随后7月高点1985至2000关口料也有持续抛压涌现。后者也是多方再次向2070纪录高位发起挑战的门槛点位,过程中4月5日高点2030预计也有一定抛压。指标方面,MACD死叉后持续朝零轴回落;RSI震荡盘跌来到中性区域,呈现金价上行动能逐渐流失的过程。

文章来源:FXTM富拓