Chapter 9 09/07 XAU/USD 延续下行颓势,留意形态营造止跌机遇

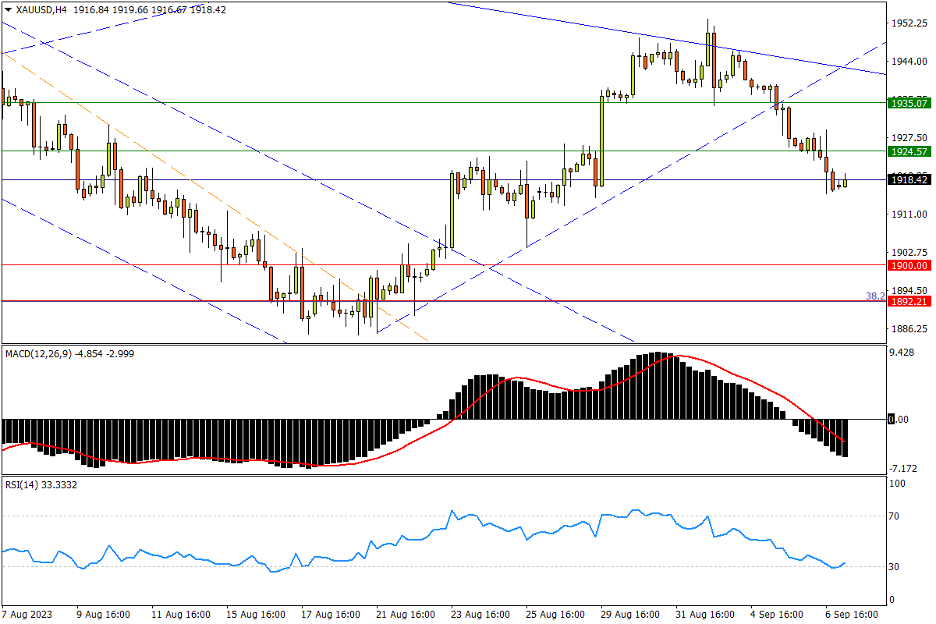

上方阻力参考: 1924、1935、1959

下方支持参考: 1900、1892、1877

日线图看,美债收益率和美元汇率的持续反弹不断施压金价,现货金大有触碰5月、7月反弹高点连线后重启跌势的趋向。下行需重点关注1900及下方一系列支撑(包含去年11月至今年5月涨势的38.2%回撤位1892,和年内低点1884)是否牢靠。同时6月、8月低点连线亦落位于此,需关注一旦在该位出现反弹,将形成打造下降楔形的机会。指标方面,MACD于零轴附近走平;RSI跌回弱势区,提示金价正直面下行压力。

4小时图看,在下破8月下旬起涨形成的支撑线后,金价扩大单边跌势,6月15日低点1924失守转为潜在弱阻。市场摆脱弱势首先需收复6-7月小型头肩底颈线位1935(7月5日高点,接近5月低点区域)之上,以保持对趋势阻力的威胁。唯破后者,反弹动能方可重新凝聚;随后2月高点1959一带有强阻驻守,而7月高点1985至2000关口料亦有持续抛压涌现。指标方面,MACD探入零轴下方后不断扩大跌势;RSI触及超卖线后略有拐头,金价跌势未见明显改观。

文章来源:FXTM富拓