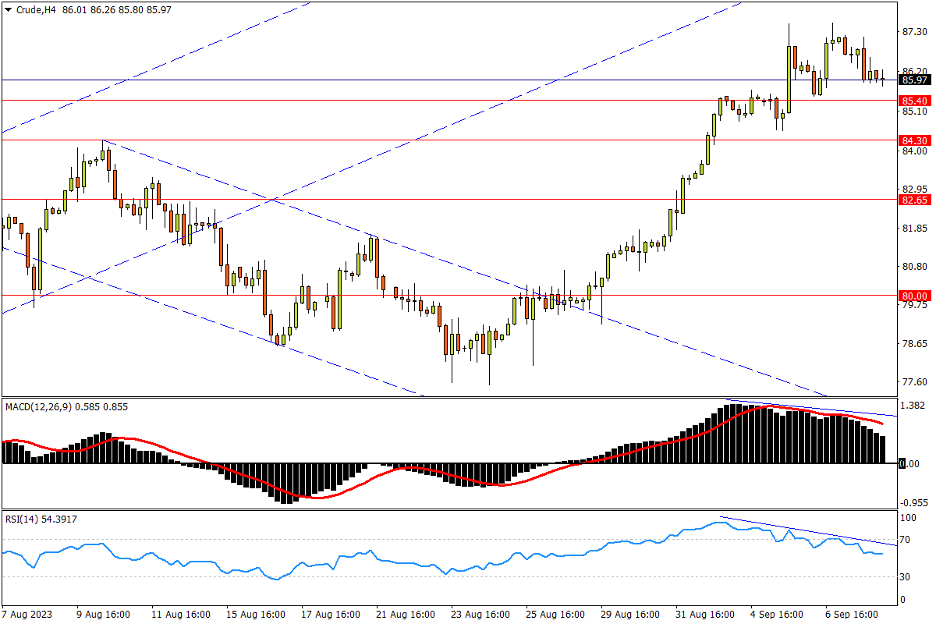

Chapter 12 09/08 CRUDE 回落中断单边升势,指标背离形势加剧

上方阻力参考: 88.33、90.00、92.29

下方支持参考: 85.40、84.30、82.65

日线图看,美元走强背景下,EIA库存数据大幅减少的利好也无法撑起油价,同时市场也在持续攀高后明显结利压力,美油因此自8月下旬起涨以来首次收出具有明显实体的阴线。回撤风险首先关注8月低位85.40至上月高位84.30一带支撑,随后下方1季度高位82.65料有稳固的买盘承接力。该位若破,多方人气将明显转淡,空方也将继而下看80关口。指标方面,MACD快线在零轴上方升势放缓;RSI跌落超买线,提示市场正面临大涨后涌现的抛压。

4小时图看,美油上行步伐虽有停滞,但波段上升常态依旧完好,唯有下破上述84.30支撑方有像样调整展开。不过多方亦需警惕持续的指标顶背离现象:MACD和RSI一段时间以来均震荡下行,与现价走势相悖。上行机会来看,油价需进一步攻破去年7月低点88.33一带弱阻以化解背离压力。随后90整数关口或将形成一定心理障碍,但对多方更为严酷的考验将来自去年3-4月双底下限92.29,该位也曾在去年10-11月限制反弹空间。

文章来源:FXTM富拓