Chapter 15 09/12 XAU/USD 倒垂头凸显反弹乏力,强阻下方仍有返跌风险

上方阻力参考: 1935、1959、1985

下方支持参考: 1900、1892、1877

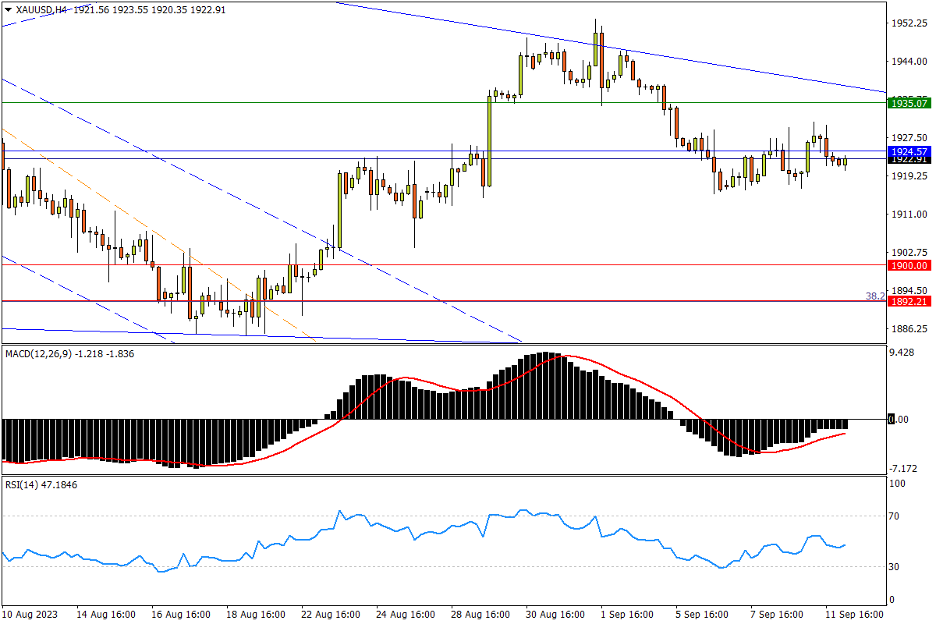

日线图看,现货金反弹虽已持续三日,但累计涨幅着实微小,并连续留下带有较长上影线的十字或倒垂头线,凸显上档压力沉重。市场可能忌惮上方6-7月小型头肩底颈线位1935与5月来跌势上轨交汇形成的顽阻。唯有悉数突破,方可颠覆中短期颓势,后续上行目标将指向2月高点1959一带抛压。再往上,6月高点1985至2000关口将成为多方挑战历史高位的门槛。指标方面,MACD继续紧贴零轴横向运行;RSI在中性区域走平,提示多空角力尚待一决胜负。

4小时图看,金价反弹仅以类似旗形的缓慢节奏向上推进,在面对上述关键技术压力位时,仍有“随时开跌”的风险。而在6月15日低点1924亦无法果断收复的情况下,市场恐难免朝1900关口继续寻底,该位下方还包含去年11月至今年5月涨势的38.2%回撤位1892,年内低点1884等多个关键支撑,同时中期潜在楔形底边也落位于此,可关注区域内的转势机会。指标方面,MACD快线于零轴下方的反弹渐失动力;RSI震荡反弹来到中性区,提示金价正处行情转折关键期。

文章来源:FXTM富拓