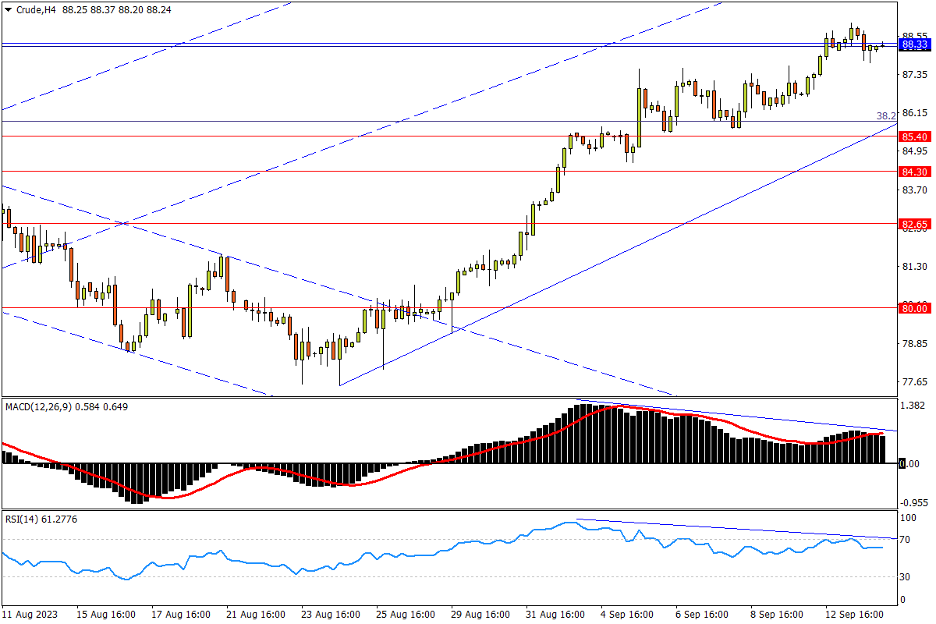

Chapter 20 09/14 CRUDE 盘中回调无碍整体强势,惟指标背离越发明确

上方阻力参考: 90.00、92.29、95.00

下方支持参考: 85.40、84.30、82.65

日线图看,虽然供应条件持续收缩,但油价上涨令通胀担忧升温,造成的政策紧缩预期对石油需求又形成潜在伤害。美油在多空因素交织下于去年7月低点88.33附近收出十字线,但市场整体向上的态势完好。更多阻力可率先参考90整数心理关,对于多头更为严酷的考验将来自去年3-4月双底下限92.29(同时接近去年6月至今年5月跌势的50%回撤位)。指标来看,MACD在零轴上方维系升势;RSI在超买区内走平,呈现一致强势的情况下需留意涨超风险。

4小时图看,美油北美时段的小幅回撤无碍市场上攻大局,但技术指标的顶背离迹象越发明确,同时MACD在零轴上方形成死叉,RSI又跌落超买线,给出诸多上行风险警告。潜在支撑来看,短期升势下轨,8月低位85.40至上月高位84.30一带形成多方初步防线。后者若破,则市场跌势成型。随后一旦下方的1季度高位82.65再失,市场人气将完全转淡,下行将继续测试80关口硬度,该位接近4月OPEC+意外宣布减产时留下的缺口上限。

文章来源:FXTM富拓