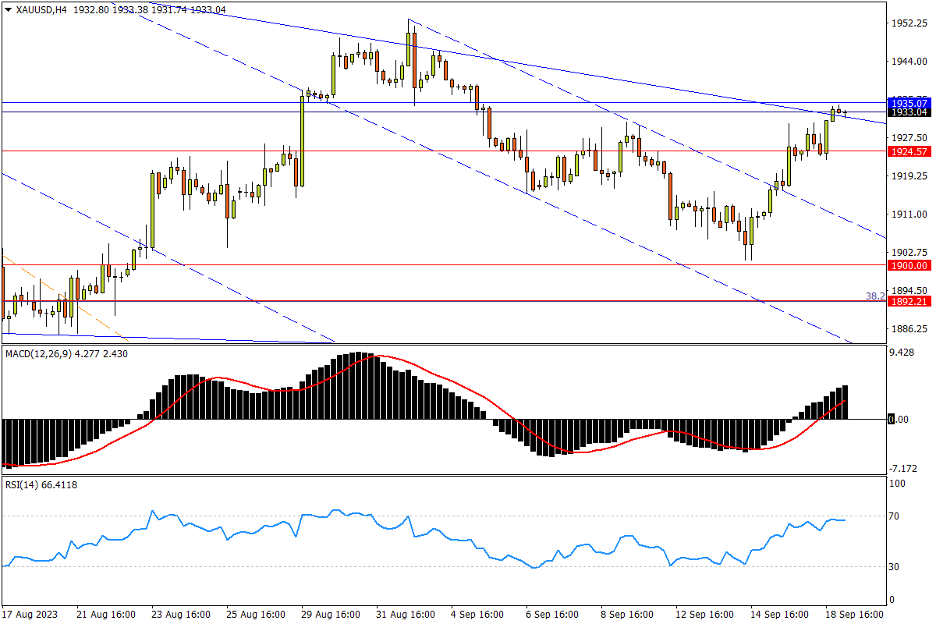

Chapter 25 09/19 XAU/USD 上看中期跌势压力,潜在回撤关注1924

上方阻力参考: 1935、1959、1985

下方支持参考: 1924、1900、1892

日线图看,主要央行加息周期纷纷接近撞线,金价连续两日攀高后逼近中期阻力区:当前6-7月小型头肩底颈线位1935,连同5月、7月高点连线对价格构成压制。突破则市场有望颠覆中短期颓势,上行进而指向2月2日高位1959。再往上,7月高点1987至2000关口将成为市场重塑冲关2070纪录水平的重要障碍。指标方面,MACD在紧贴零轴下方形成金叉;RSI震荡升回强势区,映照现价处于转势的关键阶段。

4小时图看,金价在1900支撑上方形成波段更高低点,隔夜涨势的延伸进一步放大了筑底希冀。但潜在回撤需关注6月15日低点1924,该位隔夜即限制了空方的小型攻势。一旦跌破,不排除市场在中期压力线下重启跌势的风险。随后一系列强支撑集中在1900下方:去年11月至今年5月涨势的38.2%回撤位1892,年内低点1884以及潜在楔形底边依次排列。指标方面,MACD收复零轴后仍保持陡峭的上攻斜率;RSI直逼超买线,市场转强信号明显。

文章来源:FXTM富拓