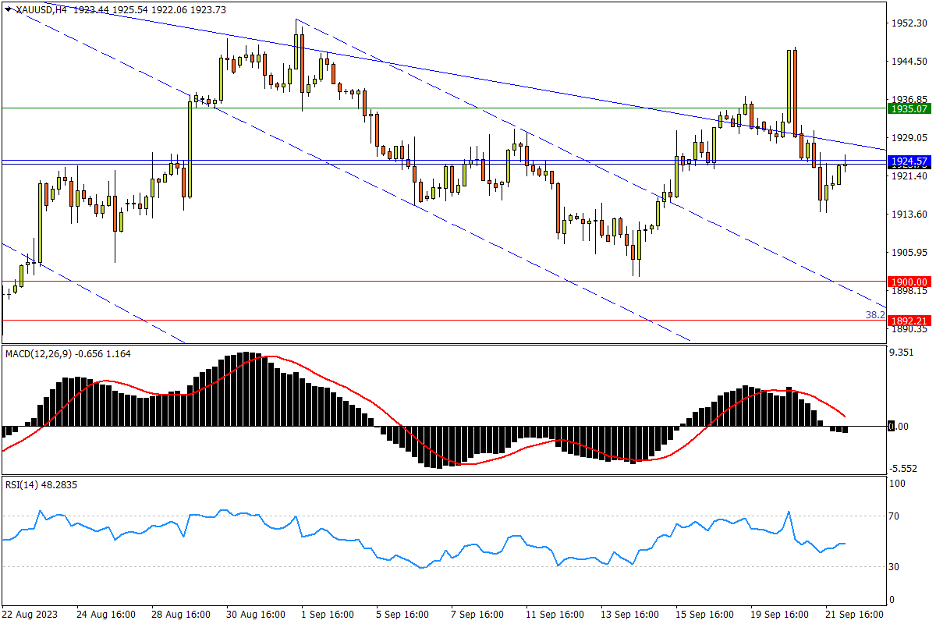

Chapter 31 09/22 XAU/USD 暂止利空侵袭后跌势,或将二次冲关通道阻力

上方阻力参考: 1935、1959、1985

下方支持参考: 1900、1892、1884

日线图看,金价在美联储的政策紧缩预期下延续调整势头,5月见顶以来形成的跌势上轨依然扮演反弹拦路虎的角色。虽然隔夜至今的小幅回升再次上看6月15日低点1924阻力,但在趋势线的合力压制下,反弹前景不容乐观。下行风险来看,多方也在1900及下方打造坚固防线:去年11月至今年5月涨势的38.2%回撤位1892,年内低点1884均为重要支撑。指标方面,MACD在零轴附近持续走平;RSI在强势区止跌,提示金价短线震荡方向未明。

4小时图看,虽然上方有顽阻驻守,隔夜金价企稳后仍有二次冲关的迹象。上行潜能来看,多方需先后站上1924、跌势上轨,以及1935(6-7月小型头肩底颈线位)三大阻力,以完成对中短期弱势的颠覆。再往上,2月2日高位1959,7月高点1987至2000关口也将有轮番抛压,后者也是市场再次上看2070纪录高点的门槛位。指标方面,MACD快线在紧贴零轴下方走平;RSI跌入弱势区后略有反弹,趋势强度同样相对中性。

文章来源:FXTM富拓