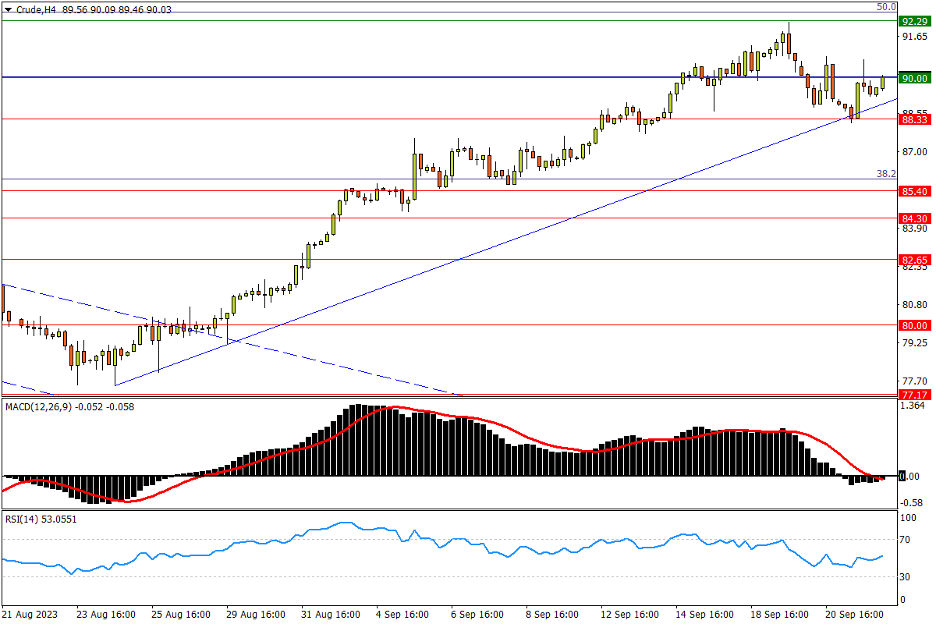

Chapter 32 09/22 CRUDE 短期升势支撑阻跌,返强需收复90关口

上方阻力参考: 90.00、92.29、95.00

下方支持参考: 88.33、85.40、84.30

日线图看,因俄罗斯宣布汽、柴油出口禁令,美油在关键支撑展开震荡后小幅收涨,止住此前两日调整步伐。行情来看,去年7月低点88.33连同8月底以来的涨势支撑线隔夜合力成功阻跌,但重新转强还有待收复90关口的确认。后续上行风险方面,本轮涨势高点(亦为去年3-4月双底下限)92.29强阻仍是多方关键目标,冲破将开启后续上行空间,更多阻力指向去年4月下旬低点95.00。指标方面,MACD在零轴上方形成死叉;RSI跌落超买线,提示短线回落风险。

4小时图看,美油震荡形成波段更低顶底,而88.33附近的双重支撑也将决定是否正式开启阶段调整。一旦失守,下行将指向去年8月低点85.40,紧接着上月高位84.30预计有较强承接力;随后1月高位成交密集区82.65多半同样买盘踊跃。再往下,空方将觊觎80整数关,该位也是OPEC+意外减产造成的跳空缺口上沿。指标方面,MACD跌入零轴下方,但快线逐渐走平;RSI进入中性水平弱侧震荡,同样提示市场面临一定调整压力。

文章来源:FXTM富拓