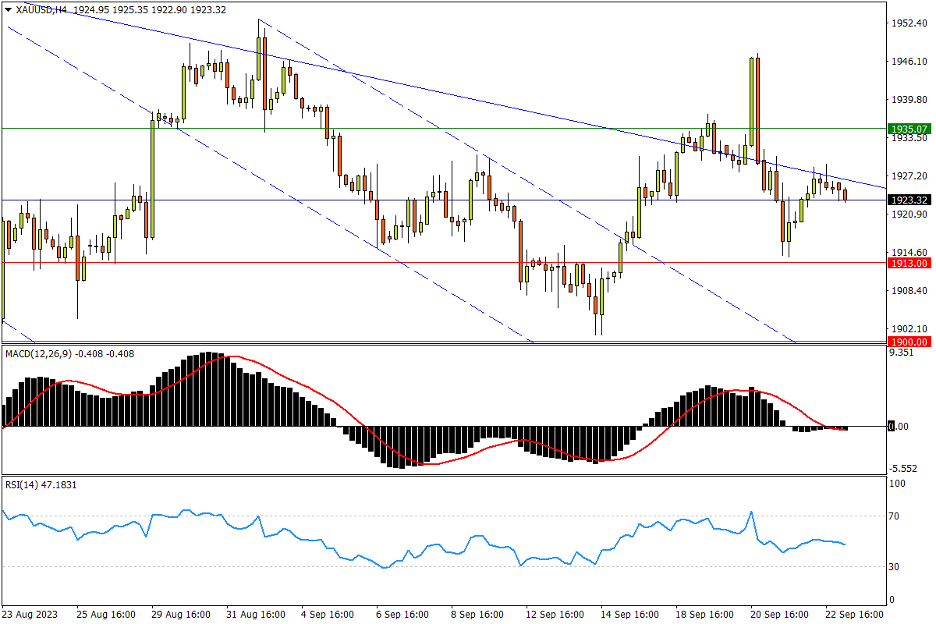

Chapter 33 09/25 XAU/USD 楔形上轨附近反复承压,形态接近突破末端

上方阻力参考: 1935、1959、1985

下方支持参考: 1913、1900、1892

日线图看,美债收益率有所回落令金价在上周末段一度攀高,但市场上行暂时仍受制于5月见顶以来形成的跌势上轨附近。走势来看,市场一方面疑似打造中短期楔形,同时在形态末端有构筑三角形的迹象。若向上先后突破1935(6-7月小型头肩底颈线位)和2月2日高位1959,则将确认形态上破。市场将进而朝7月高点1987至2000关口阻力区挺进。指标方面,MACD在零轴附近持续走平;RSI在中性水平震荡,提示金价有待方向抉择。

4小时图看,金价即期波段虽然有底部抬高的积极信号,但上周击穿跌势上轨后又遭空方强力打压,若始终无法实现突破,恐将再次探向楔形底边以求支撑。过程中目标可先看上周低点1913(接近6-7月低位头肩底形态的肩部位置);随后下行在1900整数关,去年11月至今年5月涨势的38.2%回撤位1892,年内低点1884均有潜在止跌可能。指标方面,MACD快慢线再次回到零轴附近;RSI跌入弱势区后略有震荡,趋势强度退回中性水平。

文章来源:FXTM富拓