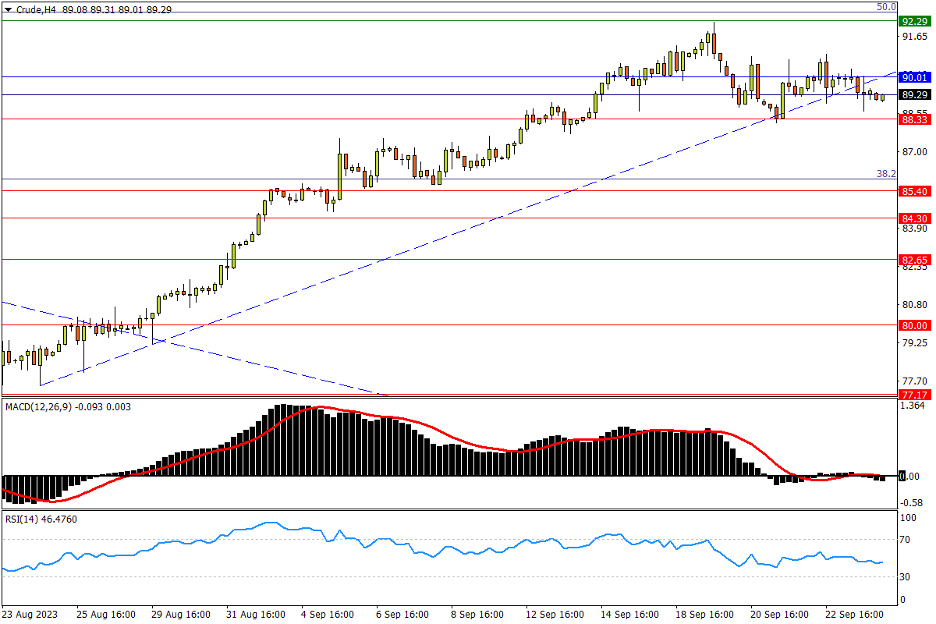

Chapter 36 09/26 CRUDE 升势节奏将破,支撑盯紧88.33

上方阻力参考: 90.00、92.29、95.00

下方支持参考: 88.33、85.40、84.30

日线图看,美联储依旧紧咬通胀的姿态不利于石油需求前景,美油隔夜小跌失守8月下旬来涨势下轨,先前凌厉攻势或将告一段落,但整体强势暂时维系。眼下去年7月低点88.33能否再次阻跌就显得尤为关键,失守则将形成波段更低低点,阶段调整亦将顺势开启。更多支撑可参考去年8月低点85.40,随后上月高位84.30亦有买盘承接。指标方面,MACD于零轴上方死叉并持续下行;RSI跌落超买线,提示美油调整风险。

4小时图看,高位震荡后,市场有逐渐磨破升势支撑的趋向,但顶部结构尚未成形。只要价格重新收复90关口,短期内仍将至少保持高位震荡的态势,并为再次冲击近期高位92.29蓄势,后者也是去年3-4月双底下限所在的关键水平。冲破将开启后续上行空间,目标进而依次指向去年4月下旬低点95.00,去年8月30日反弹高点97.20乃至百元关口。指标方面,MACD在零轴附近走平;RSI在中性区窄幅震荡,两项指标均微幅下移,提示市场正待做出方向抉择。

文章来源:FXTM富拓