Chapter 28 10/27 油价日线再次上涨破短期均线支撑,中短期均线都出现了拐头迹象

原油价格周四下跌超2%,扭转了前一天的涨幅,有迹象表明以色列正在响应国际呼吁,阻止对加沙的地面入侵,同时美国需求显示出疲软的迹象。

油价周四大幅下跌,在美国原油库存增加后回吐前一交易日的涨幅,而巴以冲突看似得到了缓解,这使原油市场获得了喘息的机会。

以沙特阿拉伯和俄罗斯为首的OPEC+今年早些时候每日减产130万桶,并于9月将减产水平延长至年底。

尽管石油市场有所回升,但仍未完全恢复并重返上升趋势。路透社报道称,“根据交易商和伦敦证券交易所的数据,由于运费上涨和炼油利润下降,全球一些主要实物市场的原油价格已经走弱,这表明需求疲软可能会影响到期货市场”。

天图上来看,油价再次上涨破短期均线支撑,中短期均线都出现了拐头迹象,中短期均线形成了金叉开口排列,目前金叉开口正在缩小,后市有继续上行的风险。MACD显示,多头动能柱有所增加,如能突破前期高位,行情有再次大幅上行需求。

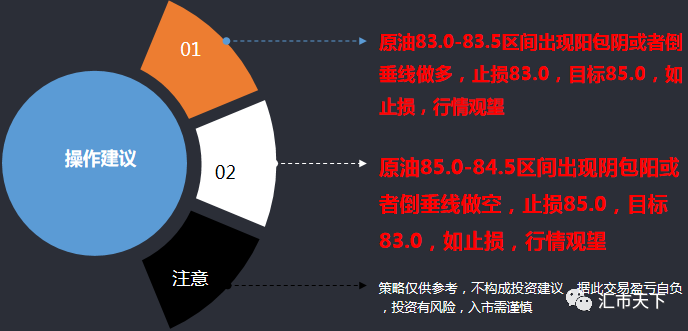

原油策略

原油半小时图上来看,周四油价走出了单边下行形态,均线三线开始转变为多空头排列,出现死叉张口扩大,后市有继续下行风险。MACD显示,空头动能柱有所增加,空头力量充足,后市有下行风险。

日内支撑:82.0、80.4、78.0

日内阻力:86.8、88.8、90.0

文章来源:“汇市天下”微信公众号