Chapter 32 10/31 WTI 原油短线全面承压

IEA将2024年全球原油需求增长预期从前期的100万桶/日下调至88万桶/日,原因是全球经济增长前景的疲软和能源效率的进步将拖累原油消费。这对市场是较大的冲击,将会让市场重新审视当前的国际原油供应格局。根据国际货币基金组织的预测,2022年全球经济增速为3.5%,而今年的预期仅仅为3%,增速下降明显,明年可能会进一步降至2.9%,随着经济增速的放缓,原油需求将不可避免的下降,油价可能因此进一步下降。

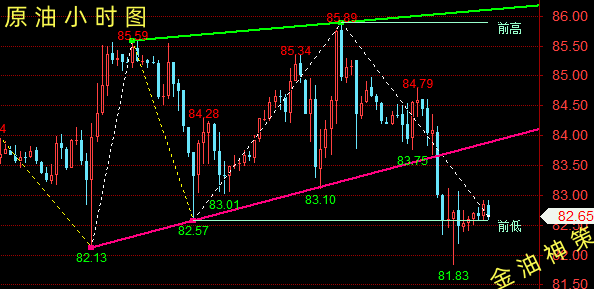

周线上,上周行情回落且收阴线,显示上方有一定的压力。指标上看,行情仍然在20日均线上方运行,若回调测试20日均线企稳,则油价仍然有进一步走高的机会。若油价下行下破20日均线,警惕油价进一步回落风险。日内关注上方84.2美元一线压力,下方关注81.5美元一线支撑。

WTI原油操作建议:

策略一:反弹84.2-84.0附近空单进场,止损0.6个点,目标82.1-81.8一线;

策略二:回调81.5-82.0附近多单进场,止损0.6个点,目标84.0-84.2一线。

文章来源:汇通网