Chapter 1 What is Fundamental Analysis?

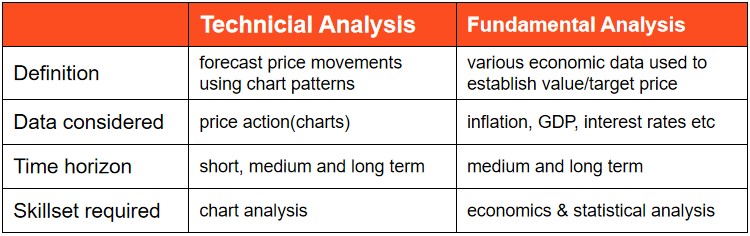

In analyzing price action, forex traders make use of two main kinds of analysis.

Fundamental analysis involves assessing the economic well-being of a country, and by extension, the currency. It does not take into account currency price movements. Rather, fundamental forex traders will use data points to determine the strength of a particular currency.

The idea behind this type of analysis is that if a country’s current or future economic outlook is good, their currency should strengthen. The better shape a country’s economy is, the more foreign businesses and investors will invest in that country. This results in the need to purchase that country’s currency to obtain those assets.

Technical analysis relies on past price movement data to predict a currency pair's future value. Traders focus on charts of price movement and various analytical tools to evaluate a currency pair's strength or weakness.

Technical vs Fundamental Analysis

Fundamental Analysis Tools

The most useful tools for fundamental analysis consist of the economic calendar, the financial news media, and historic fundamental data, central bank monetary policy, geopolitical events, and market sentiment.

Ø The economic calendar informs the trader

Report