Chapter 1 市场失衡

某个价位的供需情况可能是供需平衡,也可能是供需不平衡。如果某一方的力量显著大于另一方,这通常可以用供需比例来衡量。常用的比例阈值通常是2 5 0 %、3 0 0 %、4 0 0 %等。当供需指数显示多方力量强劲,这意味着什么呢?

这意味着在这个价格点位,主动买单显著多于主动卖单,它们两者的比值大于供需平衡的阈值。另外,按照拍卖理论,我们拿斜对角线的,也就是左下角成交的主动卖单量和右上角成交的主动买单量进行对比,如 2. 5:1、3:1、4 : 1 的成交量比例。在一根K 线内,这种不平衡点位很可能多于一个,但我们要抓住本质,那就是愿意主动进行成交的买者多于愿意主动成交的卖者,如果显示空方力量强劲,道理相同。

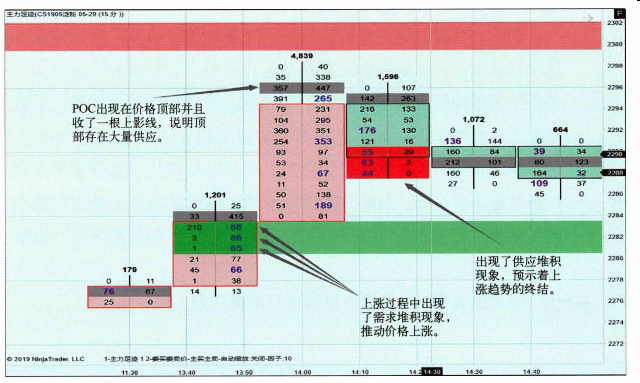

以下图表显示了供需不平衡在订单流图表上的表现形式。

我们要记住,当不平衡现象出现时,通常意味着交易机会的来临。

主动型交易者开始入场,造成了供需的不平衡,从而导致了一段趋势的开始和终结。这预示着他们已经迫不及待、争先恐后地涌入市场了,价格开始快速地发生变化。